Something for your Espresso: Gung ho or no?

Morning from Europe!

The UK economy delivered another pleasant surprise in May with GDP growing by 0.4% for the month. We’ve had a slew of speakers from the Bank of England (BoE) recently, and Huw Pill, the chief economist, has provided the most insight. He mentioned that the stickier parts of the inflation basket need further investigation, though he still believes rate cuts are a matter of when, not if.

Meanwhile, Haskel and Mann, two external committee members, have been quite hawkish. Haskel highlighted the persistent tight labor market and its role in keeping inflation above target, preferring to hold rates until inflationary pressures ease sustainably. Mann echoed this sentiment, suggesting inflation will stay above 2% for the rest of the year, influencing her decision-making. Both Haskel and Mann are hawkish external members, which is why Huw Pill will likely prove to be more important in the consensus-forming for the months ahead.

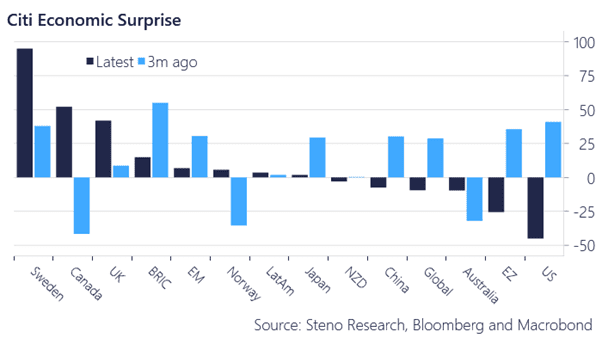

These comments underscore the difficulty of cutting rates when base effects move away from targets. We’re skeptical about a BoE cutting cycle and find it intriguing that the UK is outperforming like Canada and Sweden in terms of economic surprises, even without any rate cuts yet.

We don’t see the Bank of England cutting in August.

Chart 1: The UK joins the rate-cutters in outperforming expectations

The inflation report holds the potential to fuel the liquidity beta risk party further, and if we take clues from China, we ought to expect a soft(ish) report. The tide needs to turn on USD vs Asian FX to truly alter the picture.

0 Comments