Something for your Espresso: Gasoline Demand is BACK…

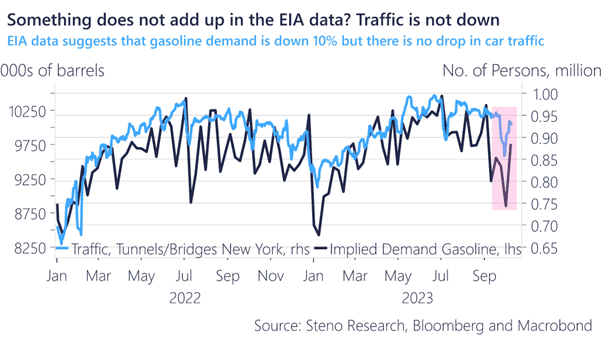

Ok, probably a bit of a baity headline since gasoline demand probably never left the building, except that the EIA weekly data suggested as much. That conclusion is now off the table again after yesterday's figure, but now the weakness has moved to oil markets. Is that fair?

Good Morning from Europe.

We were almost like kids in a candy store ahead of the EIA data release yesterday as we thought that we had found a pretty decent risk/reward in betting on a data correction in the implied gasoline demand in the US economy.

The rebound in the implied demand for Gasoline did arrive exactly as we forecasted with a rebound of around 900.000 barrel equivalents – almost 100% smack dab at our model based assumptions.

On a stand-alone basis this should be enough to take the oil-price 6-7% higher, but it seems like the demand side fears have moved up one layer in the supply chain instead, as Oil inventories have been building (according to the EIA) over the past week.

Chart 1: A large jump in the implied demand for gasoline in the EIA data

Ok, probably a bit of a baity headline since gasoline demand probably never left the building, except that the EIA weekly data suggested as much. That conclusion is now off the table again after yesterday’s figure, but now the weakness has moved to oil markets. Is that fair?

0 Comments