Something for your Espresso: Chinese DEFLATION

Abysmal price numbers from China with CPI at -0.8% YoY. It is important to note that the inflation release of relevance for the global audience is the PPI, which moved a tad in the other direction towards -2.5% YoY.

Since 2020, the Chinese PPI has become less influential on USD, EUR and GBP inflation, but more influential on JPY, KRW, MYR and THB inflation for example.

Soft Chinese price pressures hence mainly equals soft Asian price pressures post the pandemic.

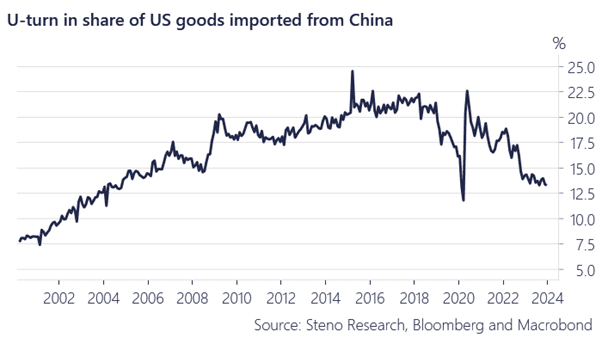

Direct trade ties between China and the US remain on the decline (see chart 1b), while trade patterns are on the increase with Japan, Korea & Thailand (to take a few examples), and they will likely see an impact from this PPI/CPI trend in China consequently.

Chart 1a: The great decoupling between Chinese and US price trends began in 2020

Chart 1b: Direct trade ties between the US and China are declining

Chart 1b: Direct trade ties between the US and China are declining

Chinese deflation is no longer as big an issue for the Western economy, while regional economies surrounding China will likely feel the consequences.

0 Comments