Something for your Espresso: Bye bye NIRP and growth?

Morning from Europe

Japan dropped into a minor technical recession this morning, but it was an interestingly muted reaction in JPY and JPY rates. Markets remain very homed in on these small moves out of NIRP from the BoJ almost no matter what happens. We also remain short CHFJPY on a policy convergence bet.

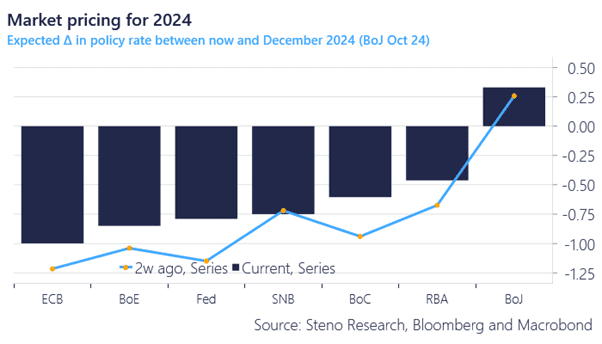

In 2024 forward pricing, markets keep seeing >25bps from the BoJ this year, which is manageable even with the baby steps suggested by deputy Ushida last week. 10bp hikes in April, July and October would fit the bill.

The ECB is back in the dovish drivers seat in forward pricing, but also the BoE has now “outdoved” the Fed in forward pricing. We mostly agree with this pricing.

Chart 1: Pricing of big central banks

Japan has entered a technical recession, but markets remain homed in on a few small hikes to bring Japan out of NIRP-territory. Meanwhile, the inflation evidence keeps diverging elsewhere.

0 Comments