Something for your Espresso: BRICS-week while EUR-flation falls apart

Morning!

The BRICS-club meets this week between Aug 22-24 amidst ongoing crises in most of the member countries. Russia is stuck in war, China is combating a fierce decline in Real Estate, South Africa is on the verge of a recession, while India still lacks the infrastructure to truly expand the non-services part of the economy, and yet we are still stuck in discussions on whether this club of nations is within spitting-distance of launching a new currency that would de-dollarize the world. Hilarious.

Don’t get me wrong. I have sympathy for the de-dollarization theme, but we are just miles or decades from something tangible still. These nations ought to combat issues at home before venturing into global reserve currency manufacturing.

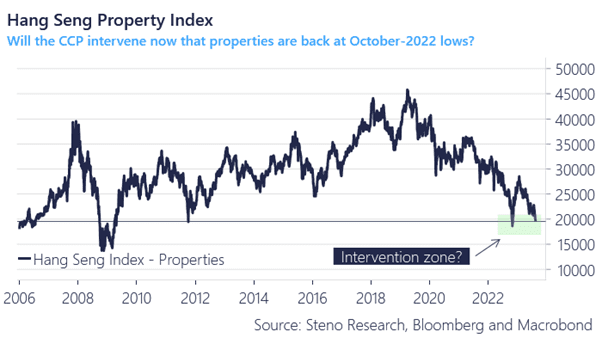

Will Xi use the occasion to solidify the CNY? We remain on China/CNY watch this week as both Chinese property indices and USD/CNY are back in “intervention territory”. Xi needs to either 1) release the SPR, 2) launch a stimulus package or something similar.

Chart 1: Hang Seng Property Index back in the intervention zone

The upcoming BRICS-meeting is the key event this week. Will Xi solidify the CNY amidst the meeting to bolster BRICS-currency hopes? Meanwhile, European inflation keeps delivering “dovish” signals beneath the hood.

0 Comments