Something for your Espresso: Ascension Day for the debt ceiling?

Happy Thursday and welcome to our daily morning briefing.

The only thing ascending faster than Jesus Christ himself is probably the level of the US federal government debt. Will this be the Ascension Day for the debt ceiling? Suddenly we apparently ought to be more optimistic around the prospects of a deal according to several journalists with sources involved in the deal brokering.

I personally doubt it, as my simple yet cynical game theoretical analysis concludes that neither Biden nor the right wing of the Republicans have an incentive to strike a deal ahead of a partial shutdown of the government, which makes a shutdown the base case for now. Once the shutdown is implemented incentives may change quickly leading to a deal within a reasonable time horizon from the shutdown commencing.

Let us remind you why this debt ceiling deal is not a straightforward event to analyze from a market perspective. Either a partial shutdown or a debt ceiling deal will mark the end of USD liquidity additions to private markets from the US Treasury. Just a few years ago that would have been a minor issue as the US Treasury did not influence USD funding markets to any significant extent but that has certainly changed with the pandemic and the new funding guidelines for the US Treasury department.

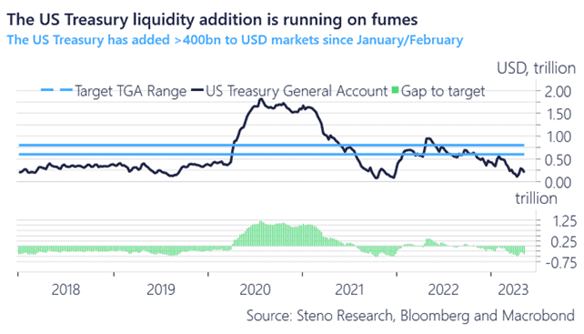

Now that the Treasury General Account is extremely volatile, it suddenly adds a load of uncertainty to USD funding markets as the US Treasury is a key player in deciding the level of USD reserves available to commercial banks. The US Treasury has added more than $400bn so far this year and will withdraw a similar amount or more swiftly after either a partial shutdown is implemented, or an actual debt ceiling deal is in place.

This kind of volatility in liquidity is a relative newcomer after the US Treasury decided to operate with a much larger running cash buffer.

Chart 1: The US Treasury is running on fumes and might suggest a partial shutdown within a $100bn from here

US politicians are busy “negotiating” a new debt ceiling while Europe is celebrating the Ascension Day. Apparently, hopefulness of a debt ceiling deal could bring about optimism in markets, but we continue to warn against taking the plain vanilla approach to the situation. Here is why …

0 Comments