Something for your Espresso: An ample year-turn liquidity in USDs

Morning from Europe after another day of USD weakness.

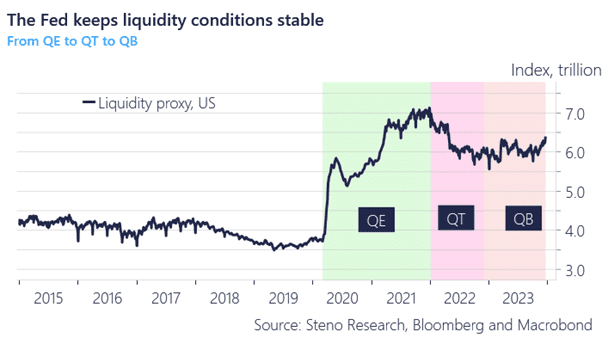

The year-turn is approaching fast and we see ample USD liquidity into the final stages of the year. USD liquidity has improved markedly relative to exactly 12 months ago, when the overall amount of USDs available to the commercial banking system was 5.56 trn compared to the almost 6.4 trn as of writing.

The most recent increase in USD liquidity has been helpful for equities and assets overall as the amount of deposits have increased in the commercial system as a consequence. We are almost back in a QE-like regime with liquidity rising fast only but for this rise in liquidity being driven by technicalities rather than decision making from the Fed.

Liquidity has likely been a bigger driver of the equity rally than actual growth prospects and with another 780bn left at the ON RRP facility, we have another strong liquidity month ahead of us in January.

Chart 1: Liquidity levels are benign compared to 12 months ago

USD liquidity is ample ahead of turn, which makes for a slightly bearish USD case. Meanwhile, risk assets are likely to continue to enjoy the cocktail of 1) improving liquidity, 2) inflation surprising on the low side and 3) growth holding up ok.

0 Comments