Something for your Espresso: A mini duration washout

Morning from Europe!

It has been a pretty nasty start to the year (not just because of snowstorms in Copenhagen), and it is frankly interesting given how everyone (partially myself included) has turned upbeat on their projections for 2024 during November/December.

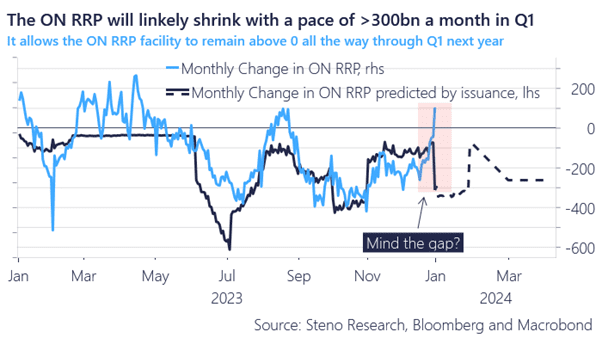

We urge a bit of caution in terms of extrapolating the mini wash-out in duration positioning from the get go of the year. The ON RRP ought to release a truckload of January liquidity in conjunction with a packed issuance calendar and minding the gap in the below chart is probably a good idea for the coming weeks.

The incentive to pull out money from the ON RRP will dwindle the closer we get to the implementation of the first cut as Bills with varying maturity will roll below the rate on the ON RRP, meaning that liquidity will not improve at the same pace once we get close to the first rate cut. It sounds counter-intuitive, but the rate mechanics support this idea.

This leaves January/February as the final months of strong liquidity gains.

Chart 1: The ON RRP is ready to release a truckload of liquidity

A relatively nasty start to the year with an according mini wash-out in positioning. Will liquidity be sufficient to keep risk assets bid through the month?

0 Comments