Crypto Crisp: Signs of Euphoria

This first edition of ‘Crypto Crisp’ is free. If you’re interested in reading future editions, please subscribe to our crypto or premium subscription.

Today, we are launching our new weekly cryptocurrency note called ‘Crypto Crisp’. In ‘Crypto Crisp’, every Monday, we will explore the upcoming week in crypto, reflecting on the previous week’s developments.

The aim of ‘Crypto Crisp’ is to efficiently and precisely bring you up to date with the crypto industry in just a few minute’s worth of reading time. Meanwhile, our editorial, Crypto Moves, continues to be released every Thursday, as always offering an in-depth analysis of a single crypto topic.

‘Crypto Moves’ is organized into three distinct sections. ‘Three In a Row’ features what we consider the most impactful news articles from the past week – not only for their current significance but also for their potential to influence future market trends. Each article is paired with a brief summary that encapsulates our takeaways and insights.

In ‘A Chart to Rule the Week,’ we spotlight a new chart each week that we believe most effectively highlights the market’s current state. This is followed by an explanation of what the chart actually signifies for the market.

In the final section, ‘Charting Crypto,’ we showcase a collection of charts that remain relevant regardless of the market’s state, thus often featuring them on a regular basis week after week. This includes the consistently rising inflow into exchange-traded Bitcoin and Ethereum products like ETFs, as well as the transaction fees on the Bitcoin and Ethereum blockchains.

Let us get started with this first edition of ‘Crypto Crisp’.

Three In a Row

- ‘Crypto world, Wall Street await potential spring approval of spot ether ETF’ at Fox Business

This Fox Business story, published a few hours after our recent Crypto Moves #15, agrees with us that an Ethereum spot ETF launches this year. Marc Powers, a blockchain professor at the Florida International University College of Law and former SEC enforcement attorney, argues that: “The SEC will be hard-pressed to come up with a new argument for denying a spot ether ETF when the same factors in the spot bitcoin ETF approval are also at play here. I don’t think Chair Gensler is going to have much of a choice.” Clearly, the market has started to factor in this scenario to the price of Ethereum with significant probability.

- ‘Coinbase Shares Surge After It Crushes Wall Street Expectations’ at CoinDesk

The largest US crypto exchange, Coinbase, reported fourth-quarter earnings after the bell on Thursday. The exchange announced revenues of $953.8 million, surpassing the $826.1 million anticipated by analysts, while the firm’s profit also beat the estimate, coming in at $1.04 per share versus an expected profit of $0.02 per share. Anil Gupta, vice president of investor relations at Coinbase, told CoinDesk that: “The ETFs are really a win-win for Coinbase, I think we’re already starting to see that play out on the platform.” Coinbase provides custody to 8 out of the ten Bitcoin spot ETFs. From our perspective, this highlights that retail investors, who are Coinbase’s most profitable demographic by a wide margin, have made a comeback to the sector.

- ‘Court clears Genesis to liquidate $1.3B worth of Grayscale GBTC shares’ at Cointelegraph

A bankruptcy court has approved Genesis’s plan to liquidate approximately $1.3 billion in Grayscale Bitcoin Trust ETF (GBTC) shares, aiming to repay its investors. We are relieved that this approval did not occur immediately after the ETF’s approval, nor concurrently with FTX’s authorization in January to sell $1 billion in GBTC. The market sentiment has significantly improved since then, facilitating the market’s ability to absorb the $1.3 billion GBTC liquidation, particularly with the $2.27 billion net inflow into the Bitcoin ETF last week. The recent surge in outflows from the Grayscale Bitcoin Trust ETF suggests that Genesis has already likely sold between $300 to $500 million worth of GBTC.

A Chart to Rule the Week

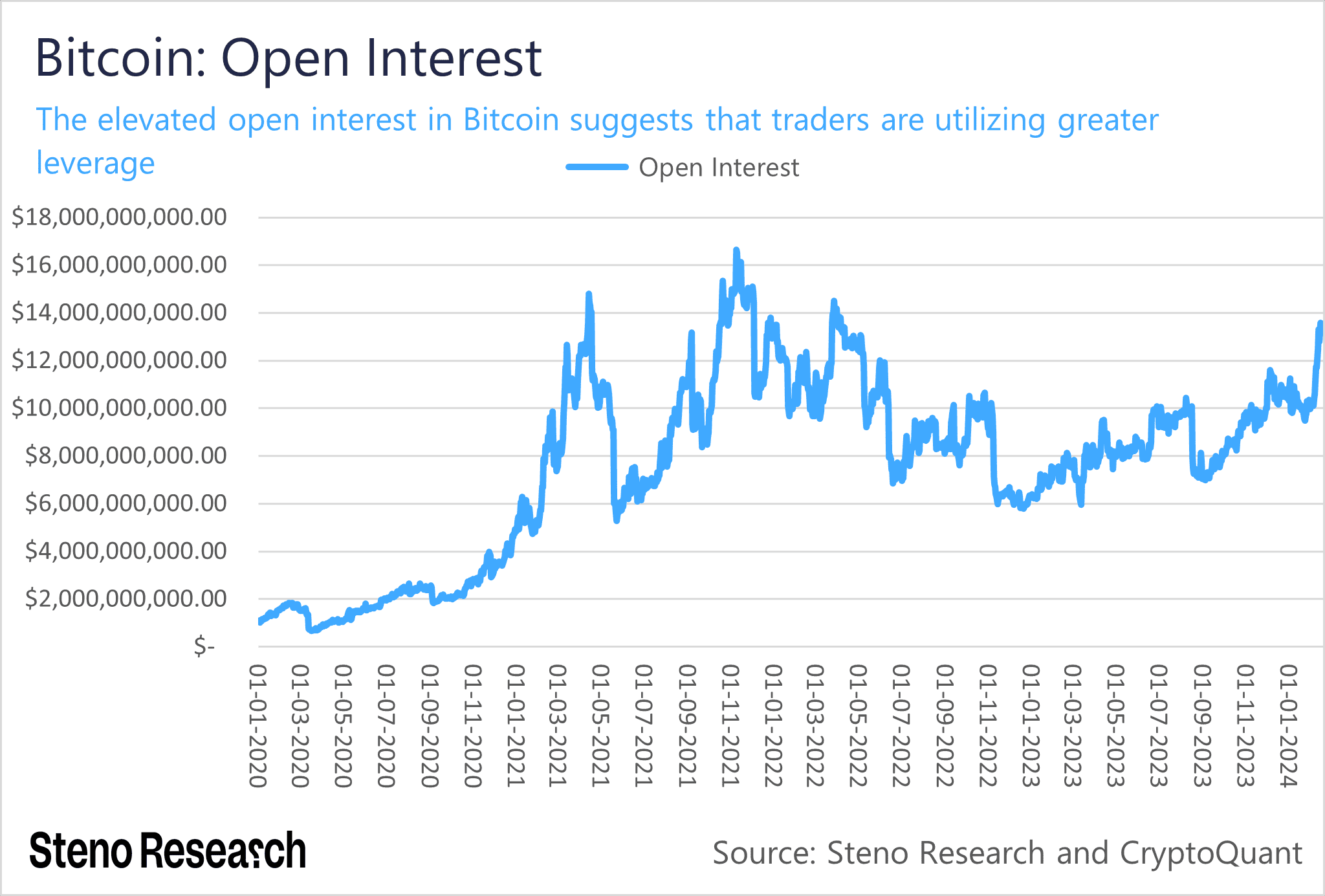

Chart 1: Bitcoin Open Interest

The open interest in Bitcoin futures has reached its highest point in almost two years, signaling growing euphoria among crypto traders and, thus, an increase in the use of leverage. This trend suggests that caution is advised when employing significant leverage, as a 20% correction could occur quickly, particularly if there is a shift in the Bitcoin ETF inflows or if there are any negative developments regarding the economy.

Charting Crypto

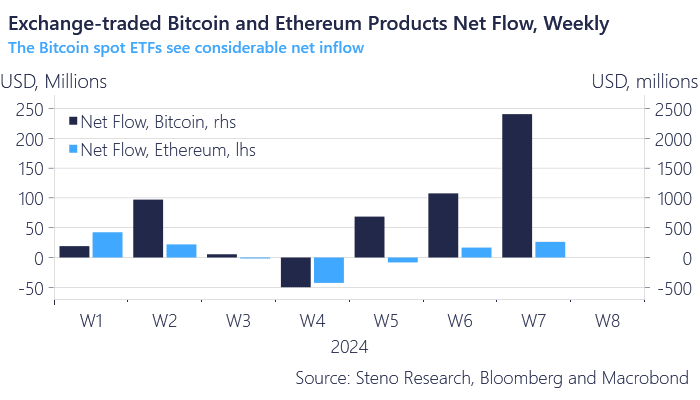

Chart 2: Bitcoin and Ethereum Exchange-traded Net Flow

The aggregated net flow in Bitcoin and Ethereum exchange-traded products, including ETFs, ETPs, ETNs, and trusts, worldwide, reflects the sentiment towards cryptocurrencies, indicating buying and selling pressure among more traditional investors.

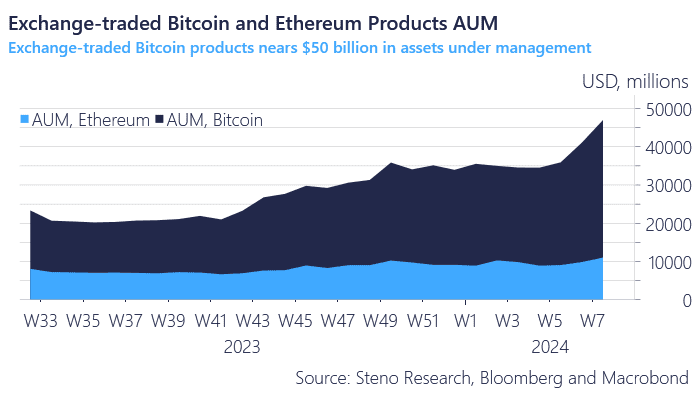

Chart 3: Bitcoin and Ethereum Exchange-traded AUM

The aggregated US Dollar-denominated assets under management of the same exchange-traded funds.

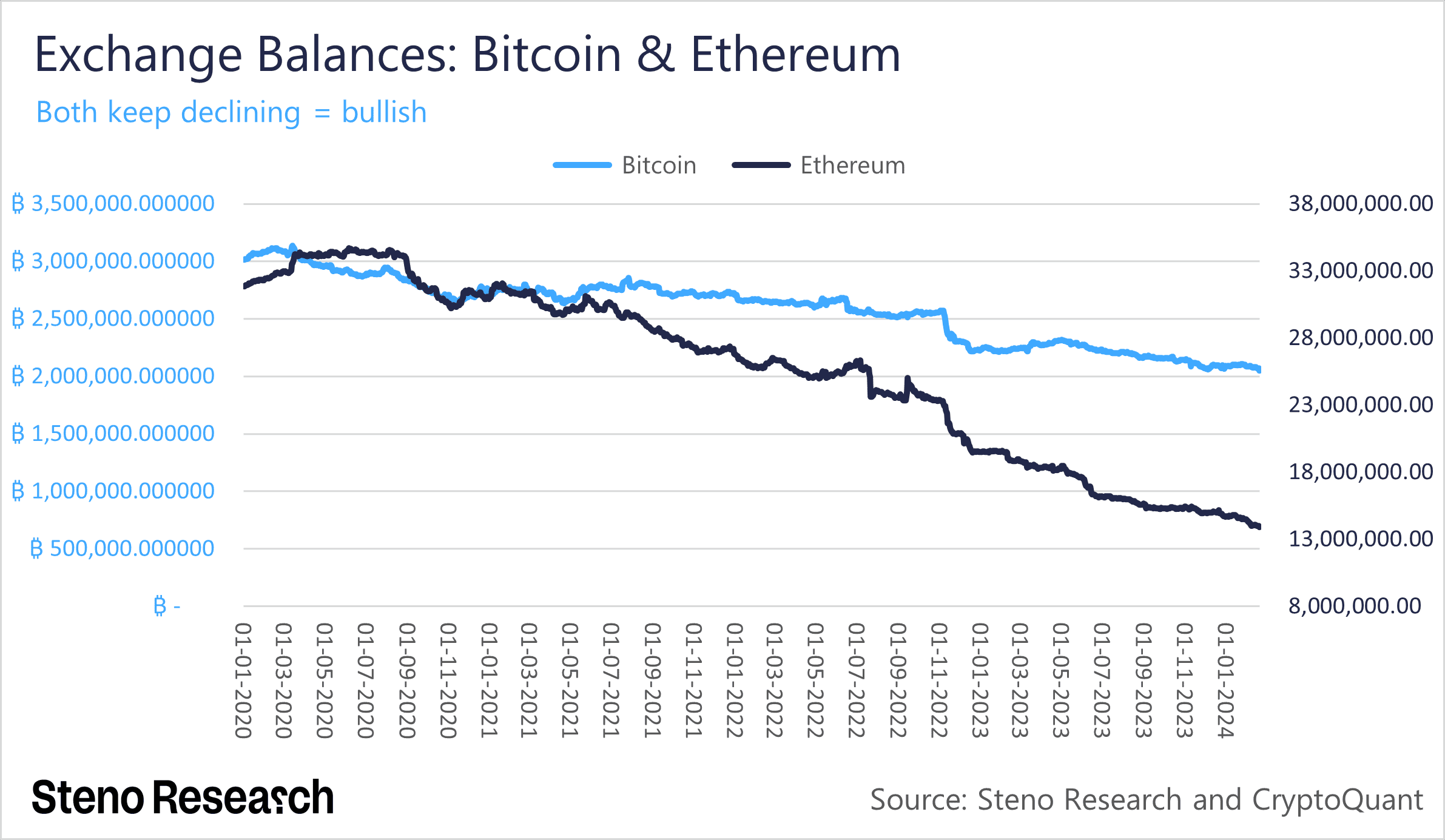

Chart 4: Bitcoin and Ethereum Exchange Balance

The exchange reserve balances of Bitcoin and Ether indicate potential selling pressure by showing how likely holders are to sell. Fewer tokens on exchanges suggest that holders are more inclined towards long-term holding or using the tokens for decentralized activities.

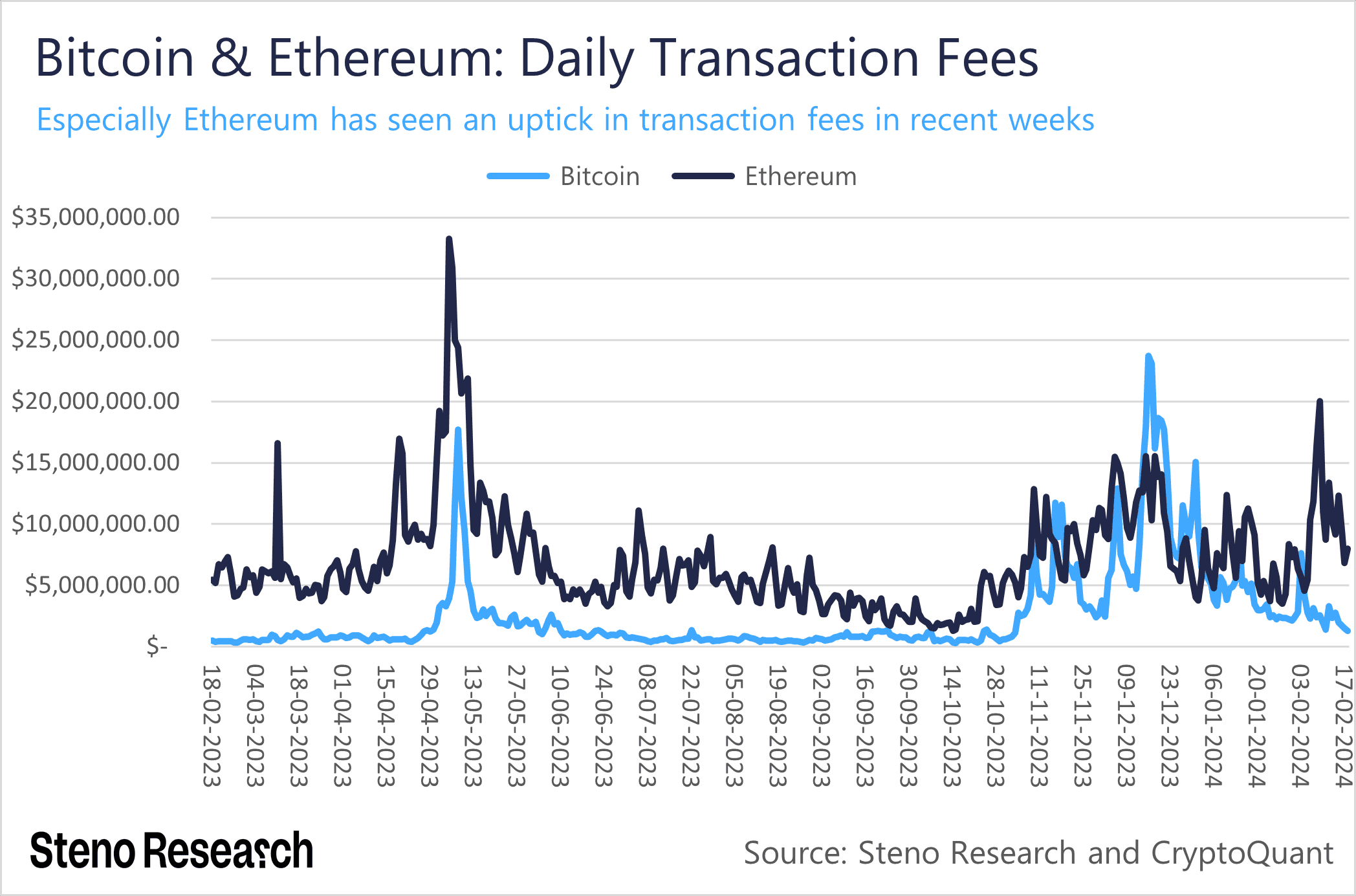

Chart 5: Daily Bitcoin and Ethereum Transaction Fees

The total daily Bitcoin and Ethereum transaction fees, assessed in US dollars, signify the degree of on-chain activity and, consequently, the amount of transaction fees paid. This metric provides insights into the overall sentiment within the crypto market; generally, higher fees indicate more positive sentiment. The transaction fees are likewise critical in Ethereum’s fundamentals.

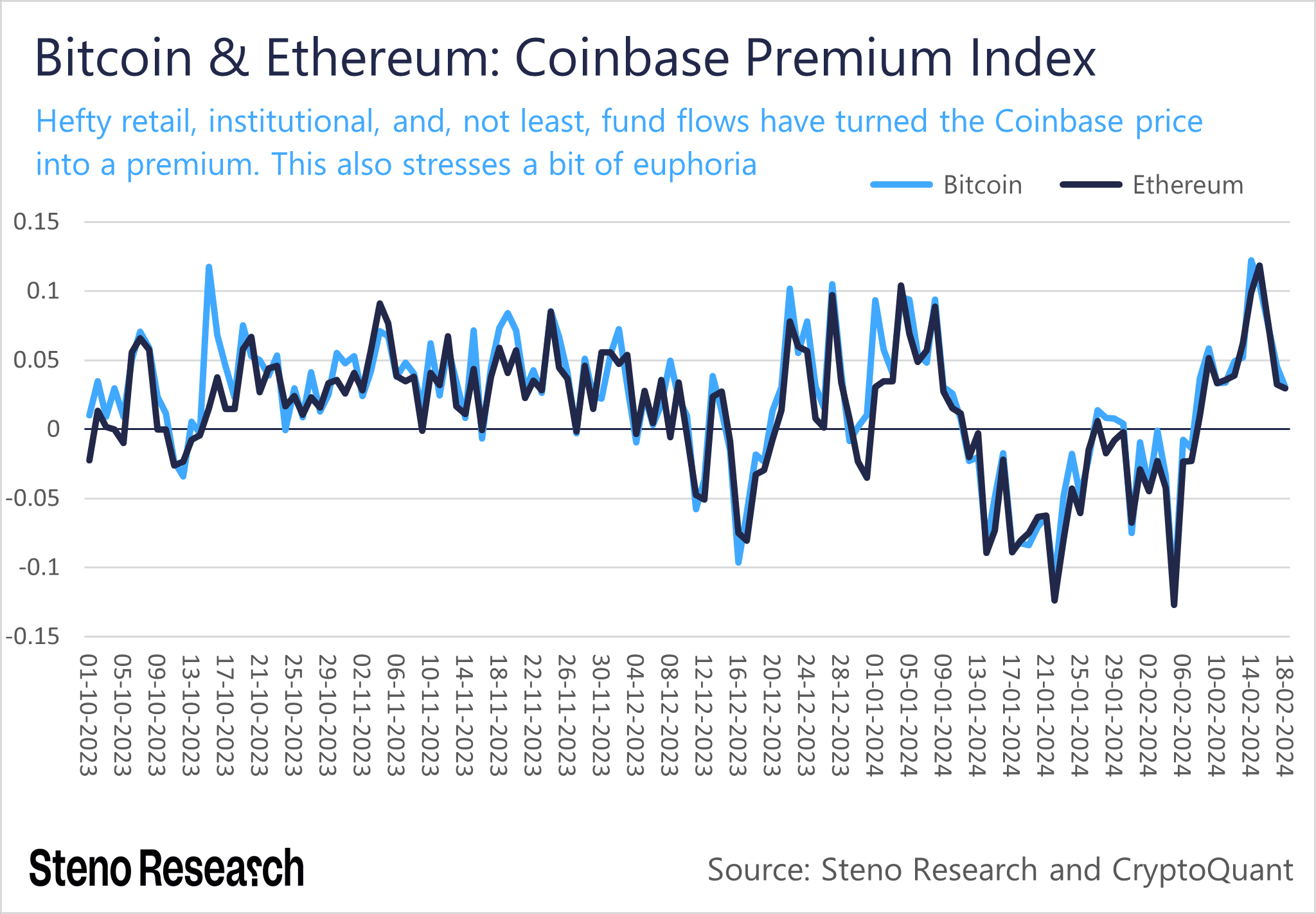

Chart 6: Bitcoin and Ethereum Coinbase Premium Index

The Coinbase spot prices for Bitcoin and Ethereum, compared to global spot prices, are particularly relevant for U.S. retail and institutional investors, including hedge funds and issuers of exchange-traded products. The premium or discount at Coinbase, and its extent, reveals how these investor groups are positioned in the market.

0 Comments