Crypto Moves #8 – Running Away from the Inevitable

The upcoming fourth Bitcoin halving is slated for April 16, 2024. During this event, the reward per block will decrease from 6.25 bitcoins to 3.125 bitcoins, resulting in a daily issuance reduction of approximately 450 bitcoins, currently valued at nearly $20 million.

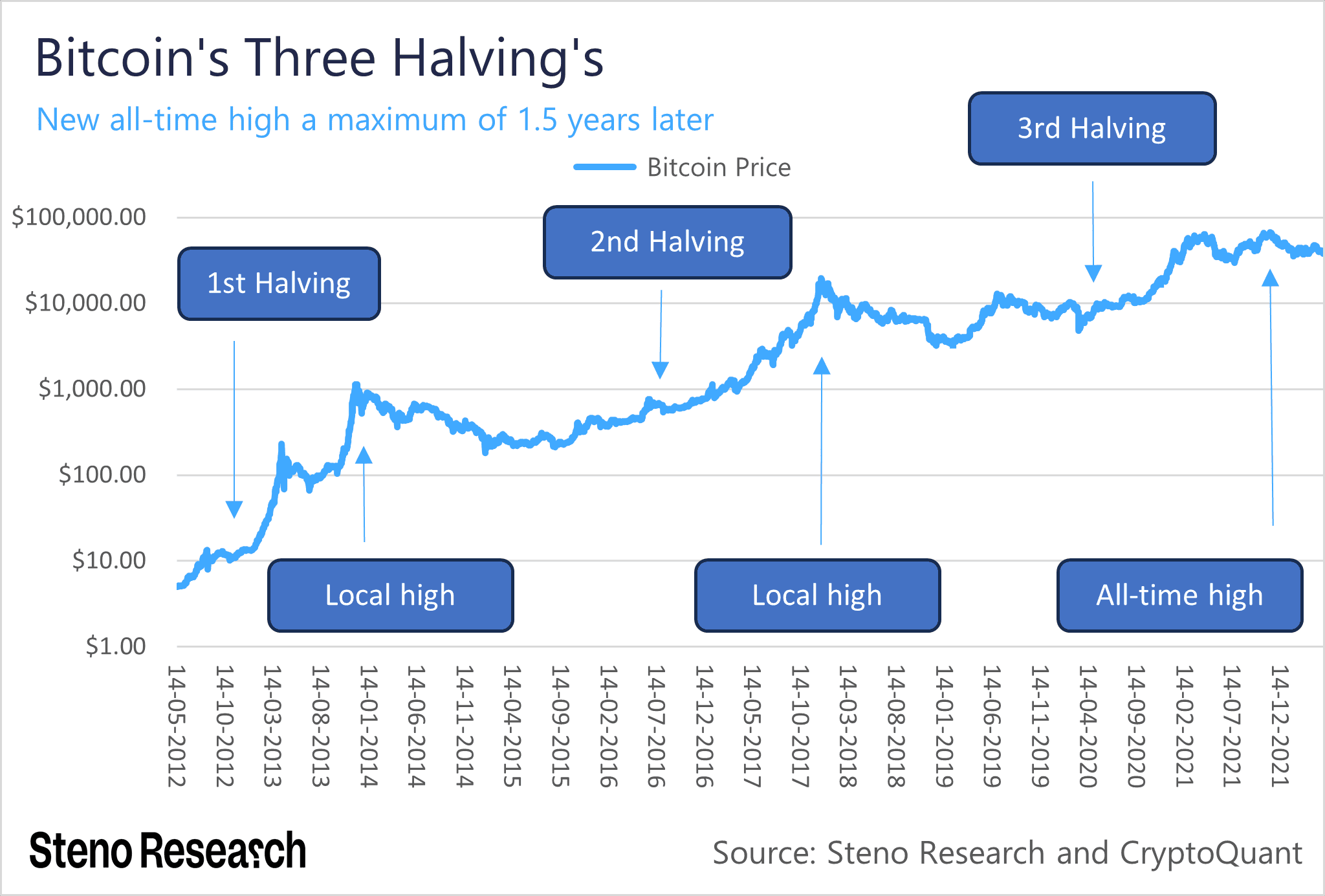

The crypto market eagerly anticipates Bitcoin halvings, and for good reason. After each of the three previous halvings, Bitcoin has consistently hit a new all-time high within 1.5 years. This trend is attributed to the supply shocks of halvings, as miners gradually sell the entirety of their rewards to fund operations.

Chart 1: The First Three Bitcoin Halvings

Despite the positive impact on Bitcoin’s price, the diminishing effect of each halving on any subsequent supply shock is notable. The change in issuance relative to circulating supply and market liquidity decreases with each halving, resulting in a delayed price impact compared to previous occurrences. Nevertheless, we anticipate that the supply shocks from upcoming halvings, including the fourth, will become evident over time, as discussed in detail in Crypto Moves #2.

While halvings offer much to celebrate, they come with a significant downside for Bitcoin – namely, a notable reduction in Bitcoin’s security budget with each halving. This aspect is often overlooked but warrants consideration, particularly for those who adhere to the “digital gold” narrative of Bitcoin.

In a few decades, Bitcoin may face challenges in covering its own security and maintaining decentralization if no alterations are made, given the halving events occurring every fourth year. The fundamental question arises: Can Bitcoin truly serve as digital gold if the outlook suggests it struggles to fund its security within the next two decades?

0 Comments