Crypto Moves #19 – Liquid Staking Protocols Are Ethereum’s Saver

It has been exactly eighteen months since Ethereum made the big switch from Proof-of-Work to Proof-of-Stake, an event widely known as the Merge.

In simple terms, after the Merge, the responsibility for verifying transactions and proposing new blocks on the Ethereum network shifted from miners to holders, provided they choose to become stakers. To maintain the blockchain as stakers, holders lock up their Ether in the network. In exchange, they receive staking rewards, which currently are about 3% to 3.5% per year.

Drawing a parallel to something I often compare to in the world of crypto, staking rewards can be seen as similar to dividends paid out by companies. However, there is an important difference to be aware of: staking comes with the risk of slashing. This is a measure designed to deter and punish validators for behavior that could threaten the network’s security or integrity, like supporting conflicting versions of the blockchain. Slashing can result in a validator losing part or all of their staked Ether, although this is quite rare. Still, it is important to understand that staking Ether does carry its risks.

With the transition to Proof-of-Stake, Ethereum has significantly reduced its security budget. This term describes the amount of resources a blockchain dedicates to maintaining its security, either its rewards given to miners or validators for their part in the consensus mechanism. Generally, Proof-of-Stake achieves the same level of security as Proof-of-Work but at a lower cost, meaning validators require less compensation compared to miners to keep the blockchain secure.

This has allowed Ethereum to dramatically lower its issuance rate from 4% to below 1% per year. Before the Merge, miners were awarded about 5.4 million Ether annually. Post-Merge, the reward for stakers has been significantly reduced to presently 910,000 Ether annually.

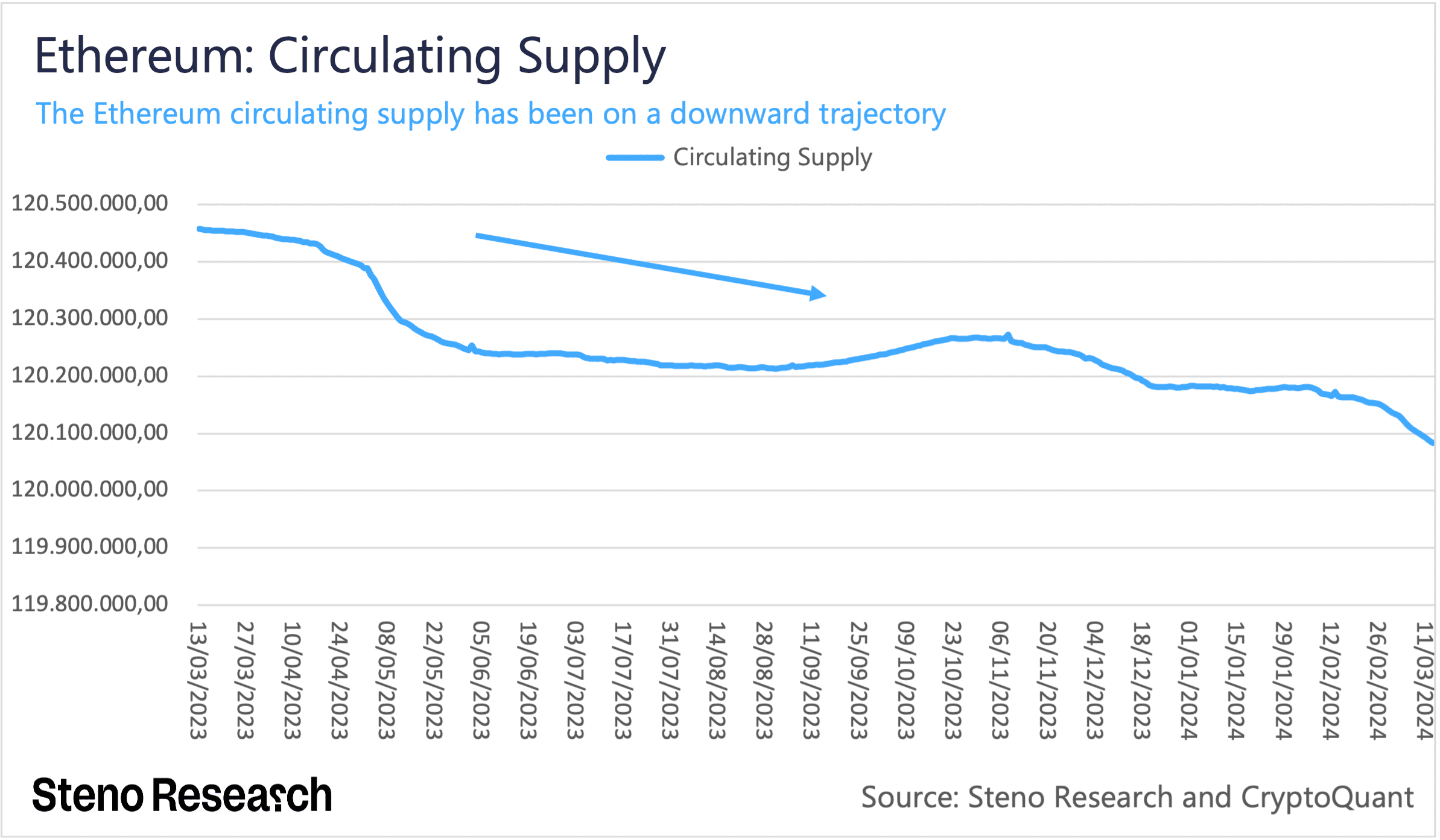

This has resulted in a decrease in Ethereum’s supply, as more Ether is burned through transaction fees than is issued to stakers. Since the Merge on September 15, 2022, over 440,000 Ether have been removed from the supply, which currently stands at about 120.18 million Ether. This scenario is akin to a company’s stock buyback program, where gradually, holders effectively own a larger share of the Ethereum network if they hold onto their Ether.

Chart 1: Ethereum Supply

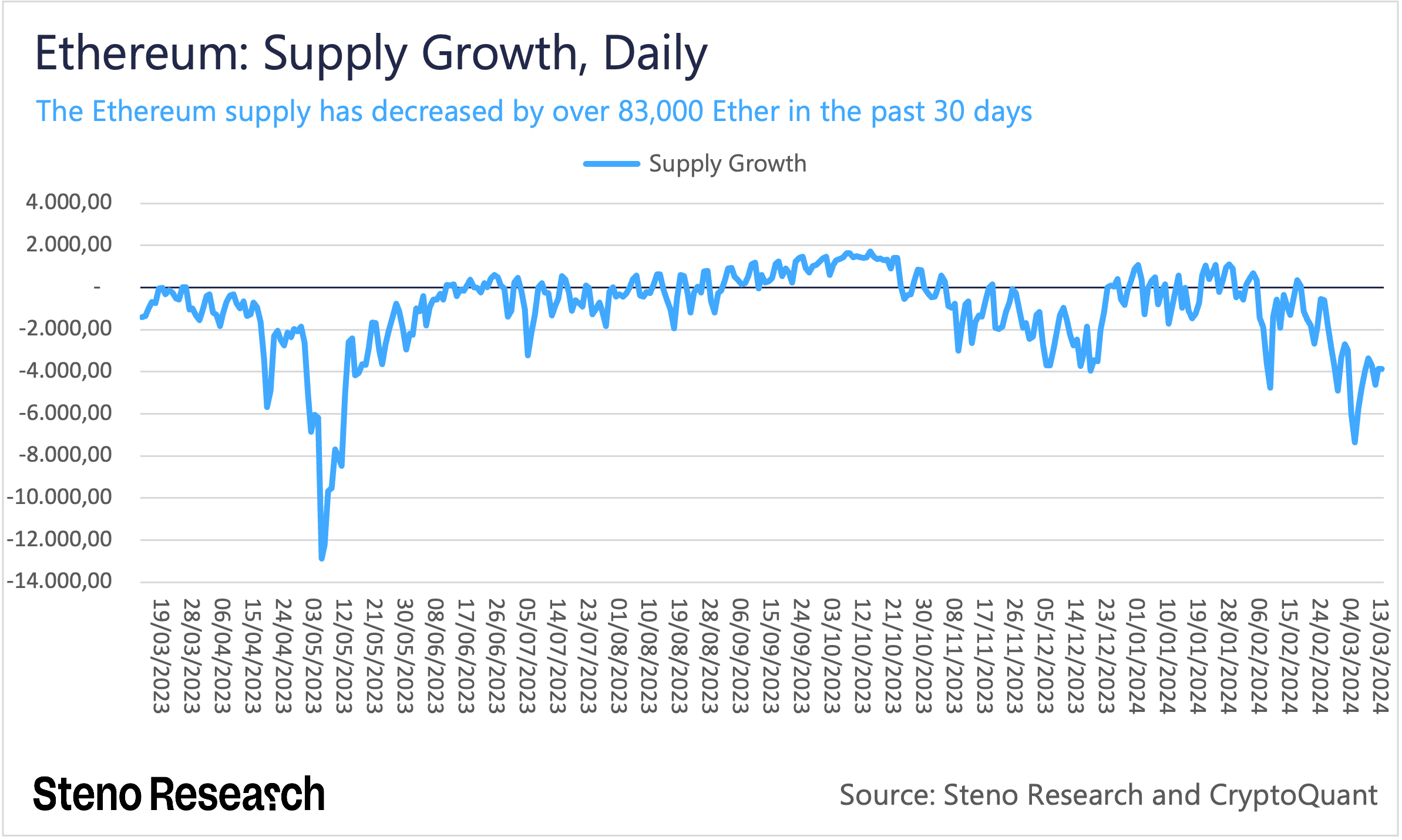

The Merge has transformed Ethereum into a truly productive asset, enabling holders to earn monetary rewards simply by holding it, setting it apart from other major cryptocurrencies. This compelling narrative has resonated particularly well with institutions and investors of a more traditional mindset, a point we highlighted in last week’s issue of Crypto Moves #18. The appeal of Ethereum has only grown recently, as demand for its block space has surged. In the last 30 days alone, Ethereum generated close to $600 million in transaction fees, leading to a significant reduction of over 83,000 Ether from the supply within just one month.

Chart 2: Daily Ethereum Supply Growth

Ethereum’s transition to a Proof-of-Stake consensus mechanism has been a significant boon, instantly positioning it as the most productive cryptocurrency among its peers. However, this success comes with a vulnerability; if future Ethereum spot ETFs gain the ability to stake Ether, Ethereum’s fate could largely fall under the control of traditional finance. The most feasible countermeasure to this scenario lies in the full adoption of liquid staking protocols.

0 Comments