Crypto Moves #17 – Is Michael Saylor, in fact, Satoshi Nakamoto?

The domain bitcoin.org was registered on August 18th, 2008. Just over two months later, on October 31st, an individual or group using the pseudonym Satoshi Nakamoto unveiled the Bitcoin whitepaper. This was soon followed by the mining of the first Bitcoin block, known as the genesis block, on January 9th, 2009.

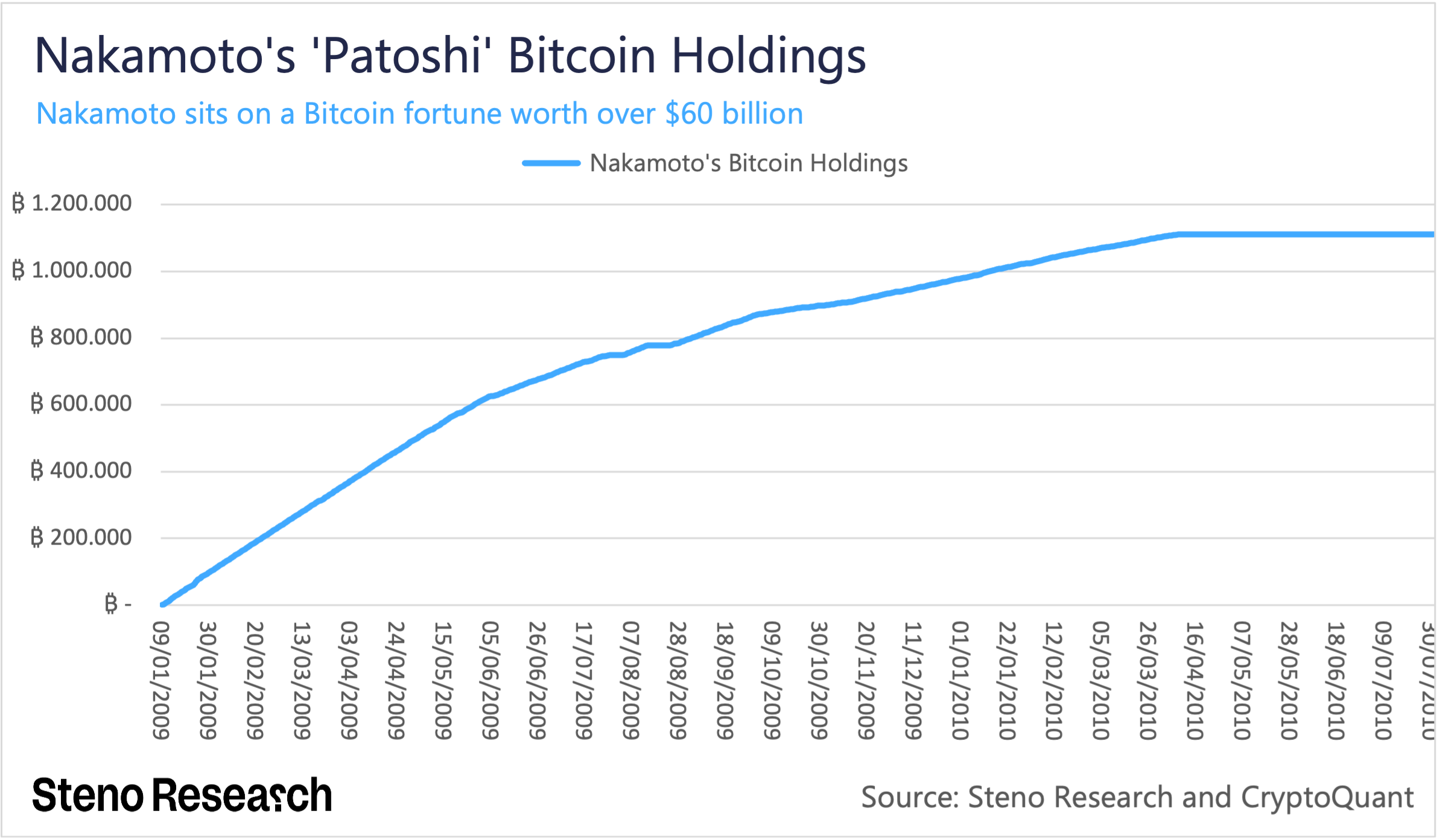

During the early days of Bitcoin, Nakamoto was likely one of the few miners on the network. It is estimated that Nakamoto mined approximately 1.1 million bitcoins, judging by the mining pattern related to the genesis block.

These bitcoins are spread across thousands of different Bitcoin addresses, which are collectively known as ‘Patoshi’, blending the words ‘pattern’ and ‘Satoshi’. It is thought that Nakamoto spent just under 1,000 bitcoins, meaning the Nakamoto-associated addresses still contain about 1.1 million bitcoins. Assuming the ‘Patoshi’ addresses truly belong to Nakamoto and no records are missing, it is safe to say Nakamoto ceased mining bitcoins by early April 2010.

Chart 1: Nakamoto’s ‘Patoshi’ Bitcoin Holdings

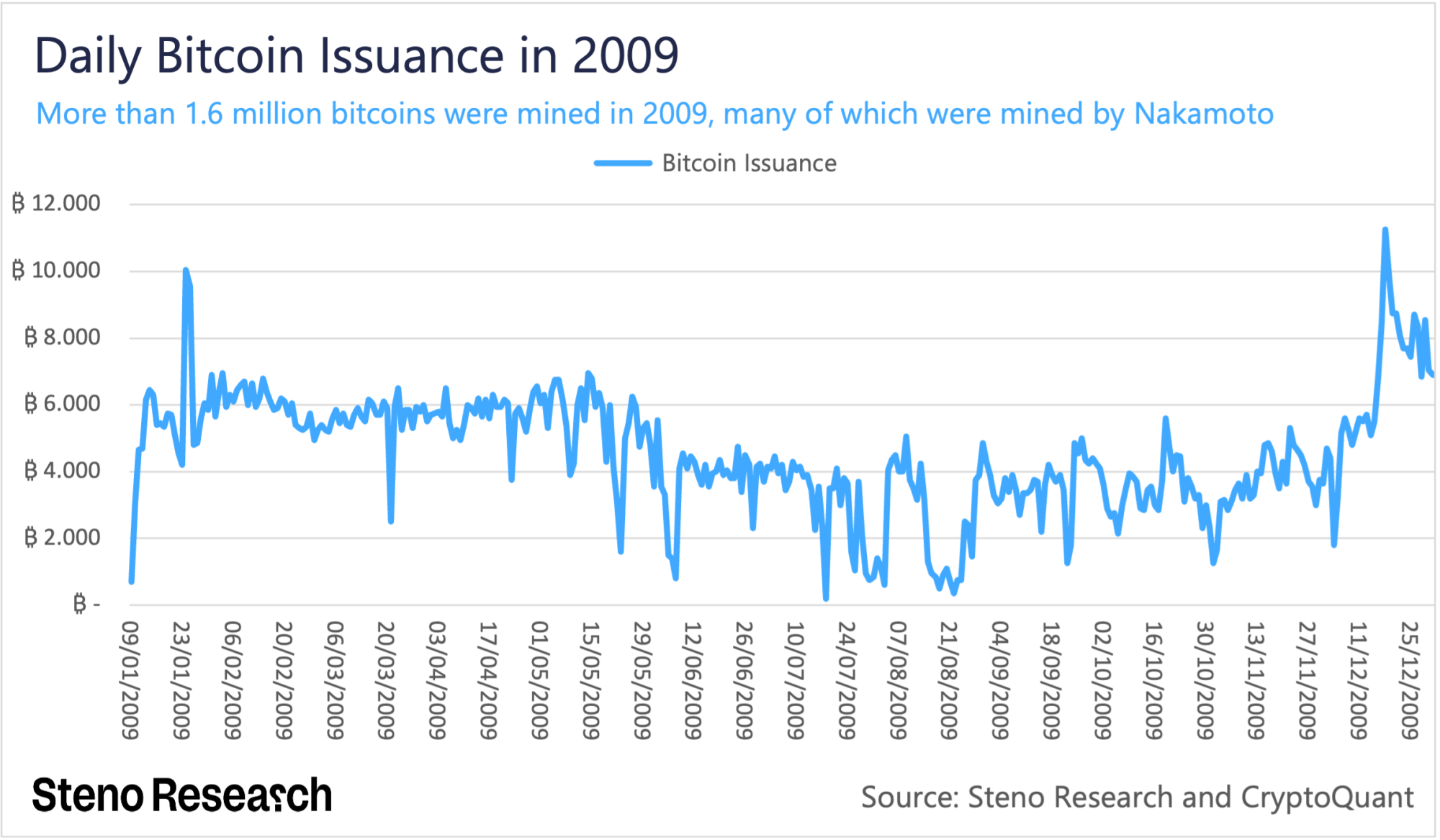

The idea that Nakamoto mined 1.1 million bitcoins might seem far-fetched at first glance. However, it is crucial to recognize that, in Bitcoin’s inaugural year of 2009 alone, a total of 1.6 million bitcoins were mined.

Chart 2: Daily Bitcoin Issuance in 2009

It is a known fact that Bitcoin barely caught any attention until mid-2010. Specifically, May 22, 2010, is celebrated for the first significant use of Bitcoin as a medium of exchange, when two pizzas were bought for 10,000 bitcoins in Florida. This iconic transaction took place roughly a month after Nakamoto is believed to have mined the last Bitcoin block.

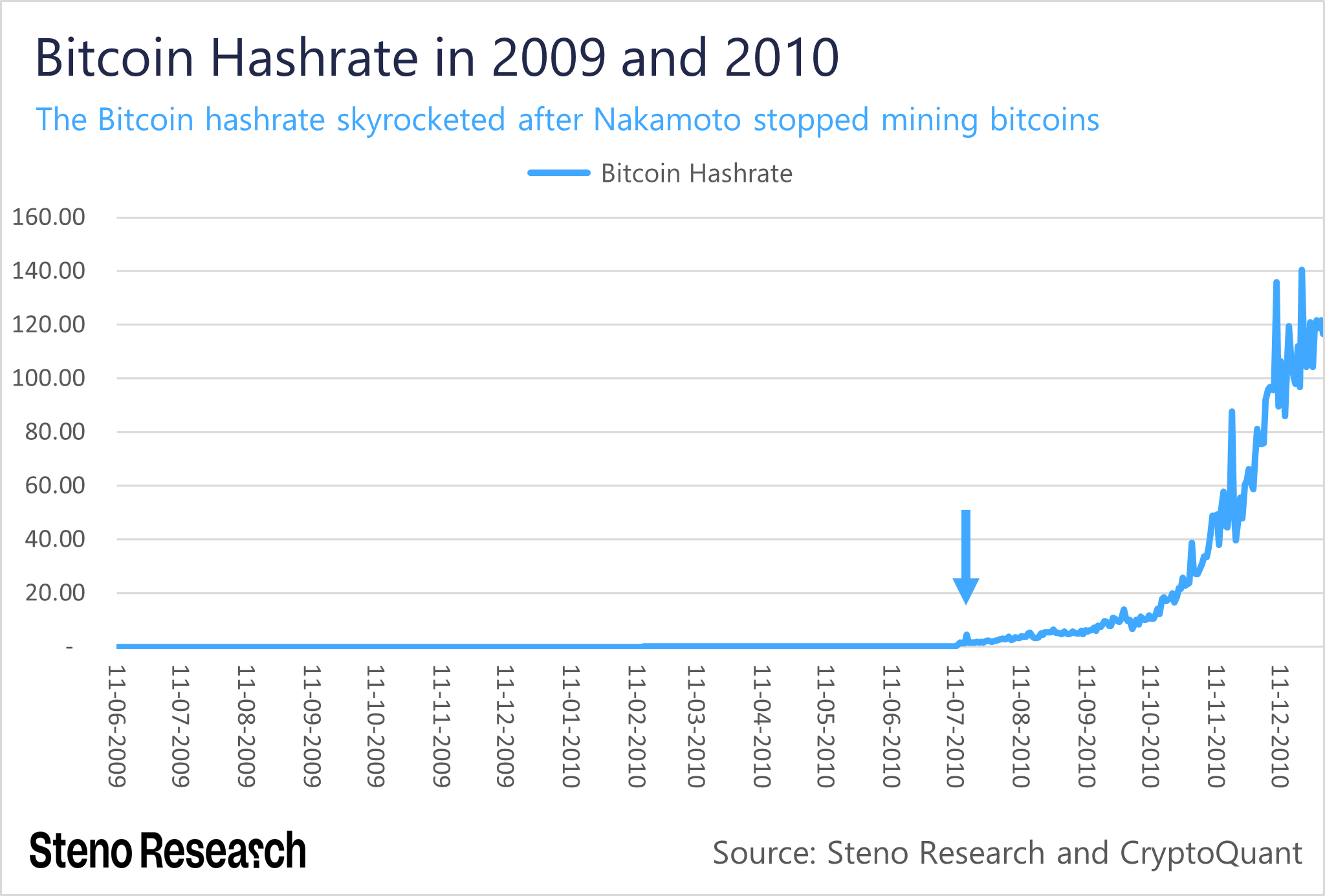

Furthermore, the Bitcoin hashrate, which measures the total computational effort applied to process transactions and secure the blockchain, indicates that Bitcoin did not start to gain traction until sometime in 2010. This is evidenced by a notable increase in the hashrate in July 2010.

Chart 3: Bitcoin Hashrate in 2009 and 2010

This suggests that Nakamoto nearly single-handedly sustained the network for over a year. Given that Nakamoto contributed the majority of the computational power, the network was not decentralized during this time. However, this likely was a strategic choice to ensure the blockchain remained operational for its few users and less susceptible to malicious attacks. The goal was presumably to maintain the network until it attracted enough miners to become self-sustaining and decentralized. Nakamoto possibly felt confident enough in the network’s future to cease their own mining efforts by April 2010.

Despite the potential value of Nakamoto’s 1.1 million unsold bitcoins amounting to over $69 billion, it is plausible that Bitcoin represented a financial loss for Nakamoto. Nakamoto invested in mining – albeit modestly – and reportedly never sold any bitcoins, without any assurance of Bitcoin’s success. If true, this underscores that Bitcoin was driven by interest, passion, and a philosophical commitment to creating a decentralized global payment system, rather than any financial gain or recognition. It is important to note, though, that we cannot confirm if Nakamoto mined additional bitcoins not accounted for in the ‘Patoshi’ set, particularly if they resumed mining after April 2010 using different methods.

While Nakamoto is believed to have stopped mining in April 2010, they remained an active participant in the Bitcoin community. Nakamoto engaged with other developers on the Bitcointalk.org forum and through numerous direct emails, continuing to contribute to Bitcoin’s development for some time.

Only one has previously had more supremacy in Bitcoin than Michael Saylor of MicroStrategy, namely Satoshi Nakamoto. Saylor has emerged as a leading figure within the Bitcoin community, with his dominance appearing unending – a scenario Nakamoto aimed to avoid. We are concerned that Saylor’s influence may soon become undeniably irreversible.

0 Comments