Crypto Moves #25 – Ethereum Restaking: Potential is Not Risk-Free

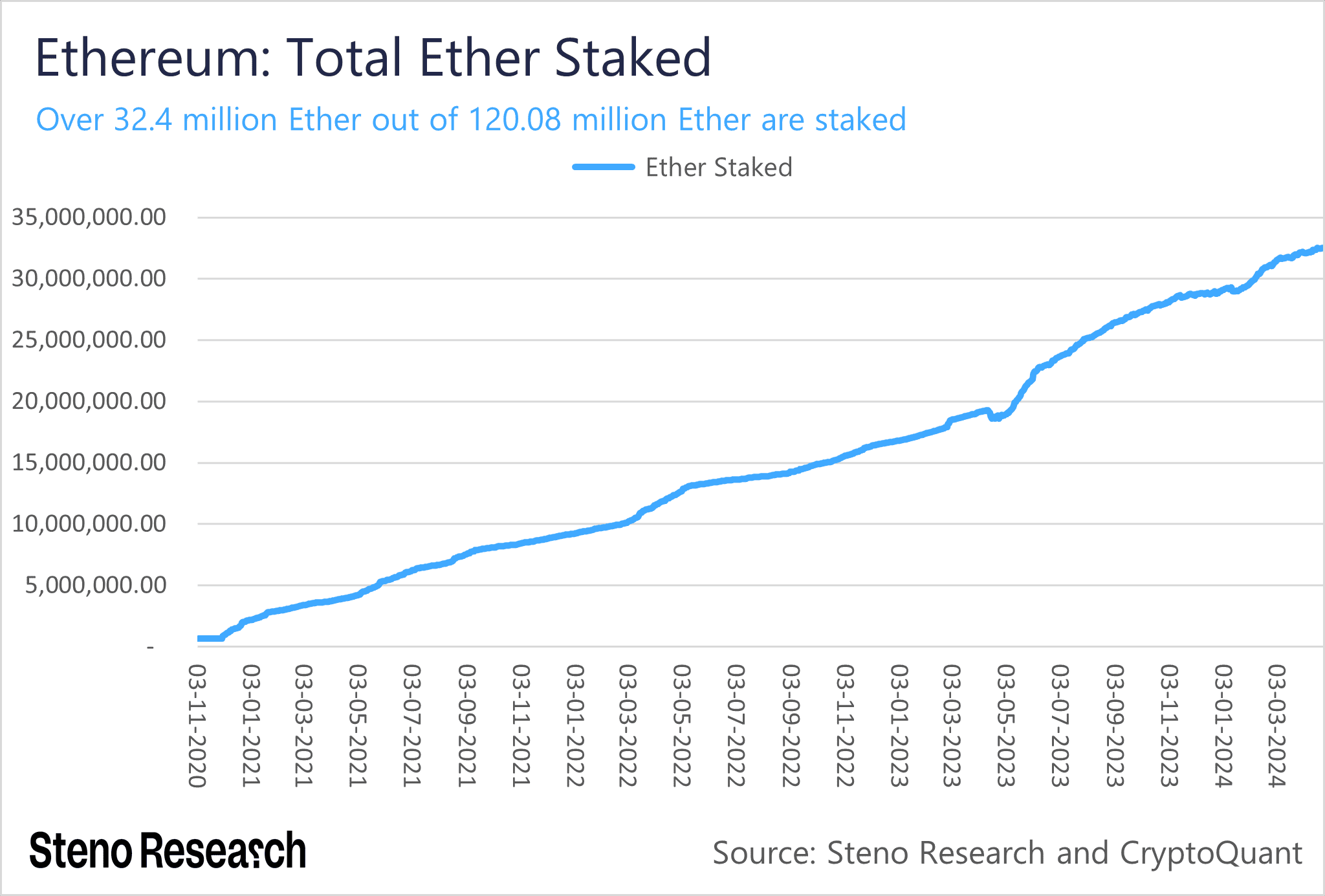

Every day, 32.5 million Ether, valued at more than $100 billion, are used as collateral to verify transactions, propose blocks, and protect the Ethereum blockchain from external attacks by acting as validators. These Ethereum validators consequently hold substantial influence over the network.

To manage this influence wielded by Ethereum stakers, the network has the capability to slash validators. This punitive measure is designed to discourage and penalize validators for actions that may compromise the network’s security or integrity, such as supporting conflicting versions of the blockchain. While slashing can lead to a validator losing part or all of their staked Ether, it is relatively rare.

Chart 1: Total Ether Value Staked

What if the community could leverage the same Ether and hardware to benefit other areas within the ecosystem? This is precisely the concept of restaking.

Restaking simply involves using the Ether already staked and its associated hardware as collateral and computational power to validate, operate, and secure protocols and applications throughout the Ethereum ecosystem, not just the network itself. The possibilities for the types of protocols and applications that could be developed based on restaking are limited only by our imagination. This includes Ethereum bridges to transfer assets to and from other blockchains, which may not be directly related to Ethereum. It also encompasses oracles, which typically provide the Ethereum ecosystem with essential data such as the prices of Bitcoin and the S&P500, crucial for numerous protocols like lending platforms.

By utilizing restaking, it is also feasible to develop protocols with ultra-low latency, while still maintaining high trust and security. This could circumvent Ethereum’s comparatively high latency for economic finality, which can be up to 12 minutes. This new level of finality, backed potentially by billions in restaked Ether, is especially beneficial for trading protocols. Furthermore, restaking can be applied in Data Availability (DA) and as sequencers for Ethereum Layer 2 solutions, as discussed in issues #16 and #20 of Crypto Moves.

The benefits of restaking are clear for all involved. It is far from being a zero-sum game. For developers of protocols and applications, restaking offers access to a significantly larger pool of capital and computational resources. This enables them to enhance the security and validation of their on-chain protocols to a new level, beyond relying solely on their native tokens.

This also benefits the Ethereum ecosystem as a whole, including Ethereum holders, by potentially enabling safer, faster, and entirely new protocols on Ethereum. These advancements could expand the network effect and adoption of Ethereum, leading to increased on-chain activity. This, in turn, drives higher total transaction fees, which effectively serve as Ethereum’s revenue. Consequently, this not only enhances staking rewards but also results in more Ether being burned.

As Ethereum restakers are inherently Ether holders, they stand to benefit from the broader ecosystem and the potential for increased transactional revenue. In addition to these indirect benefits, restakers also earn protocol fees and rewards from the protocols they support with their Ether and hardware. This is in addition to what they already earn from native Ethereum staking, effectively amortizing the capital cost of Ether staking and introducing an additional financial incentive for holding Ether, which could potentially exert upward pressure on Ethereum’s price.

However, the concept of slashing is as integral to restaking as it is to traditional Ethereum staking. This means that restakers, like traditional stakers, may be subject to slashing by any protocol they support if they fail to adhere to the protocol’s rules.

Restaking of Ether, with initiatives like EigenLayer, has the potential to significantly enhance Ethereum, benefiting holders, stakers, developers, and the broader ecosystem. However, these benefits are not without their drawbacks. Engaging in restaking carries substantial risks for the individual holders involved and also poses systemic risks to the Ethereum network as a whole.

0 Comments