China Watch: Trading the latest rate cut stimulus

The record-sized 25 bps cut to the Chinese 5-year prime lending rate signifies the importance of the nation’s property sector, and it goes to show the returning support from authorities.

Capital flows have been one-way traffic out of Chinese markets since early 2022, but returning FDIs, early cyclical momentum, still exponentially growing demand for chips and tech and rising global trade, does speak in favor of China as an investment case once again. Despite the tumultuous circumstances, China is still the 2nd largest economy and a driving force in global macro. And so, we’ll, contrary to most, dare to offer our take on the mixed signals it’s sending currently.

Takeaways from the get-go:

- Our now-cast shows…

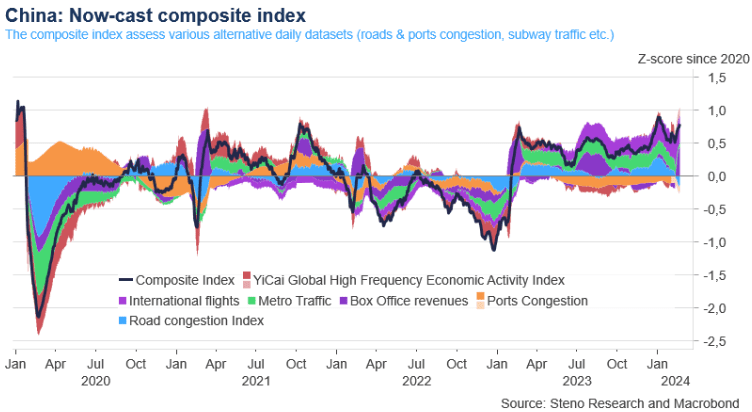

The global economy, piloted by the US, is stronger than most had feared and probably expected at this point in the cycle, and though China battles with unrelated issues of their own, our now-cast shows domestic activity at post-Covid highs. Accounting for the muted congestion (particularly on roads and ports) due to the Lunar New Year, this figure would have been even higher.

Early-mid-January 2024 made the current high, but the trend speaks to further momentum, and it has even improved again over the past 1-2 weeks. Though today’s German HCOB PMIs disappointed and admittedly surprised us, it does rhyme with the early signs of improvements in European activity in our now-casts.

All else equal, the pick-up in true activity in China speaks well for our cyclical rotation of the portfolio on a trend basis, if it persists.

Chart 1: Now-cast composite activity index

Was Tuesday’s aggressive stimulus just the PBoC’s latest desperate attempt, or was it in fact enough to get the distraught property sector and broader economy back on track? Our interpretation of the mixed signals here.

0 Comments