Steno Signals #117 – 25bp equals mayhem, while 50bp equals panic?

After a major dash for cash at the start of September, markets regained some optimism last week (much to my surprise, in all transparency). A weak USD, soft USD rates, and soaring precious metals characterized the week, especially after Mr. Fed source #1, Nick Timiraos, wrote an article suggesting that a 50bp cut is in play.

USD weakness is something we often observe when the Fed begins cutting rates, as they are perceived to be much more reactive and aggressive than their peers. This weak USD is typically replaced by a stronger USD if the true dash for cash arrives, especially if the Fed cuts due to a weakening economy.

I tweeted this meme back in July or August as we began considering whether the Chinese cycle could potentially kill the momentum in Gold and Silver, in addition to the already struggling Oil, Iron Ore, and Copper markets mentioned in the meme. Admittedly, I have had this short Gold view stuck with me, despite making money on the short side of the other four commodities.

I guess I can live with that, but oh boy, the Gold rally has certainly surprised me, to be fully transparent.

Meme of the week: This meme aged like goat milk

If we dial back a few months, we saw waning interest from Asia in buying precious metals as the tide turned on the USD. Thankfully, we mostly got the major move in USDJPY (and USDCNH) right, which saved us from being completely wrong-footed by Gold.

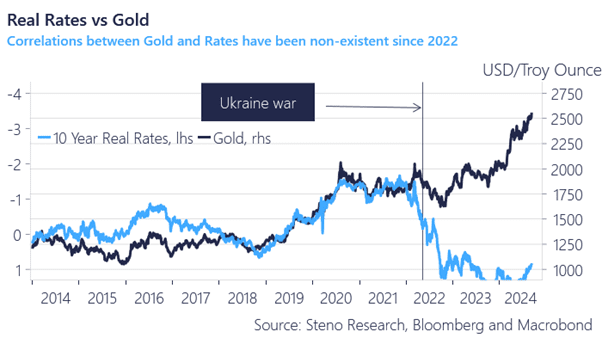

The Asian demand for Gold has somewhat disappeared, but I underestimated the power of real rates and Western flows as we approached the cutting cycle.

The Gold-to-real-rates correlation broke down when Russia invaded Ukraine (and Russian SWIFT assets were seized), but Westerners have now taken over the trade, which became very evident with the rally following Timiraos’ 50bp article on Thursday.

I’d like to remind you that Westerners are short-term Gold buyers, while Asians are in it for the long haul, making this Gold rally much more vulnerable to a dash for cash.

The big question is whether we will see such a dash for cash now that the Fed seems to be going all in on the cutting cycle.

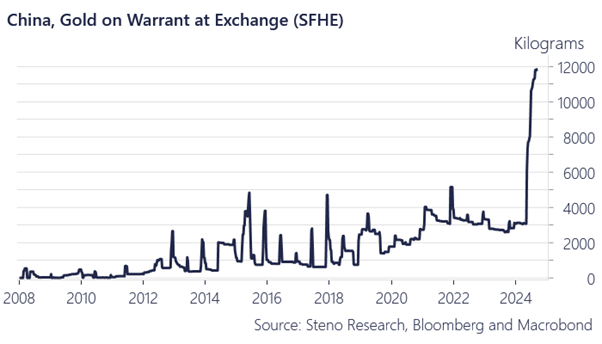

Chart 1a: China is posting record amounts of Gold at exchange. Why?

Chart 1b: Real Rates back as drivers of Gold after a long disconnect

The decision between a 25bp or 50bp rate hike is of utmost importance this week. In either case, it likely makes sense to continue leaning into Fixed Income, as markets are neglecting inflation and focusing solely on growth.

0 Comments