EM Watch: 5 Charts on the Nosediving Chinese Indicators!

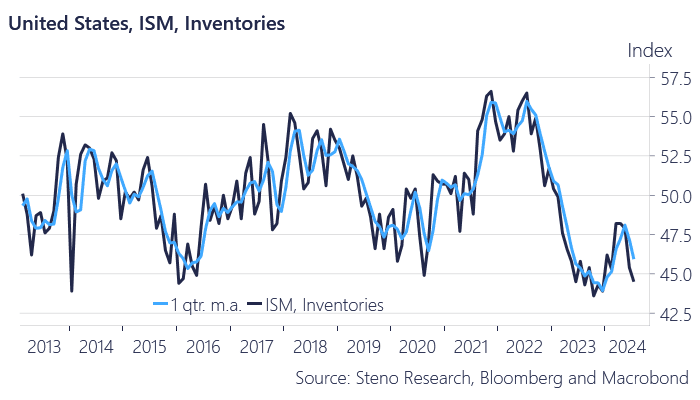

China’s exports fired on all cylinders during the spring, but we are now starting to see signs of fading inventories in the US (and to some extent, Europe) again.

We believe the front-loading of imports, with rising freight rates being a symptom of this, propelled the Chinese economy ahead of the feared tariffs implemented by the Biden administration and potentially increased under a Trump presidency.

We know that Chinese exporters have front-loaded exports of cars and other goods ahead of the tariff deadlines in both the US and Europe, and we are now seeing freight rates moderating alongside some concerning nowcasts out of China.

Here are five charts showing that Chinese momentum is nosediving again.

Chart 1: The Western inventory build-up during the spring and early summer is long gone

The Chinese momentum has come to a sudden halt, and we think it is related to the front-loading of imports due to tariff fears. Could China become the victim of a wait-and-see approach until after New Years?

0 Comments