5 Things We Watch – US CPI, Japan, China, Germany & Central Banks

Welcome back to our weekly 5 Things We Watch, where we go through 5 things that we keep an eye on in the world of global macro. With Japanese wage negotiations and the US CPI report out, there are plenty of things to shed some light on, so let’s get to it!

This week we are watching out for the following 5 topics within global macro:

1) US CPI Report leaves the Fed in a difficult situation

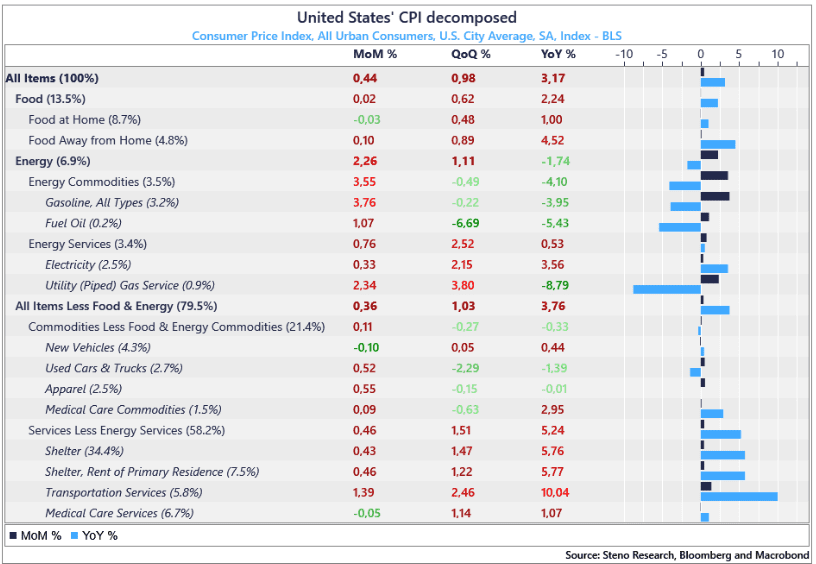

Yesterday’s CPI report revealed that the inflation outlook is not as benign as the Fed would have hoped, with energy / transportation services dragging the MoM figure higher. Food came in soft, and the shelter-component has somewhat normalized, which gave markets the opportunity to rally given that the CPI ex everything (removing transportation services and shelter from core) ended up soft…

The report was certainly not what the Fed had hoped for, especially given the relative overweight of services in the CPI basket in the US compared to EZ/UK (65% in US vs 40-45% in EZ/UK). If services components continue to be sticky, the Fed will have a much harder time justifying the cuts laid out in December last year.

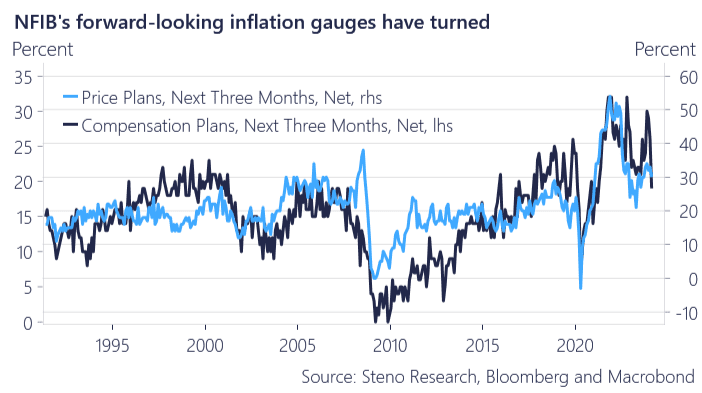

On a more dovish note, the recent release of the NFIB survey showed a sharp U-turn in expected compensation plans, which until now pointed towards stickier wages in Q1/Q2, and the Price Plans expectations have also turned, which leaves a more dovish outlook than feared.

Chart 1.a: US CPI Decomposed

Chart 1.b: Forward-looking indicators have turned soft

The US CPI report came in hotter than expected yesterday, and today’s news on Japanese wage negotiations give the BoJ another reason to tweak the policy rate. Read about the 5 things that we watch this week here.

0 Comments