Something for your Espresso: Let’s all start cutting in June, while the BoJ hikes

The wage negotiations at Toyota have been settled and it looks like a decade-long record has been set. Toyota agreed to monthly increases of as much as 28,440 yen ($193) and record bonus payments, and while they never present the changes in %-terms, it looks like we are on path to >3.5% wage growth in the broader Japanese economy given this.

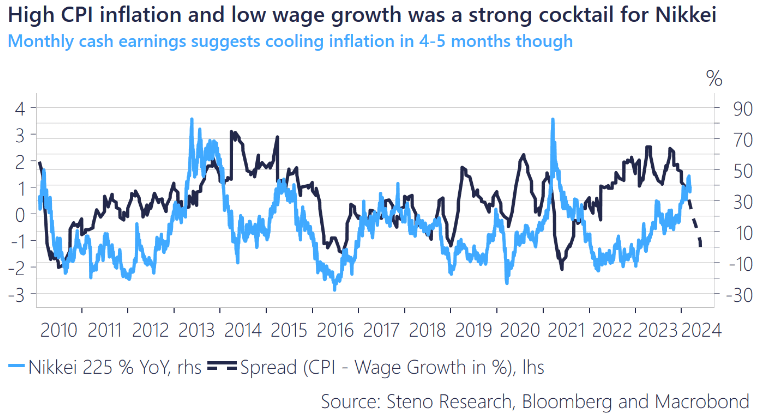

Toyota furthermore urges suppliers to follow suit, which is what we are yet to see in the Japanese economy. Large caps are raising wages, but it hasn’t truly passed through to a wage pressure among SMEs yet. The monthly cash earnings print at 2% YoY, but if we assume a >3.5% path paired with CPI inflation around 2% on a trend basis, the “margin party” for large cap Nikkei companies is likely over for now.

The rotation from Japan into China and South Korea continues this morning in equity space and we are leaning the same way. Being short JGBs and long JPY are still decent macro trades, but the Nikkei momentum is likely going to fade hard.

Chart 1: The margin party is over in Japan

Strong and firm signals from Japanese wage rounds solidifying the hiking case, while markets have honed in on June as the timing for the first cut from ALL other central banks of major size. Should make for an interesting macro environment.

0 Comments