5 Things We Watch – Rates pricing, Bond positioning, Equities setback, USD Wrecking Ball & Inflation markets

Macro is truly back with central banks and pricing of policy rates back on the top priority list amongst traders and investors. Powell’s remarks from yesterday confirmed fears of the Fed deviating from their promised rate cuts back in December, and the question will now be, whether they will cut rates at all. A pivot from a pivot is tough, but it might be exactly what’s going to happen.

The hawkish remarks and expectations have sent shockwaves through markets, with the USD wrecking ball seemingly coming back, while equities take a breather in April. Read along as we dissect 5 things that we keep an eye out currently.

This week we are watching out for the following 5 topics within global macro:

- Rates Pricing

- Bond Positioning

- Equities setback in April

- USD Wrecking Ball

- Inflation markets

1) Markets are starting to agree on 0 Fed cuts this year

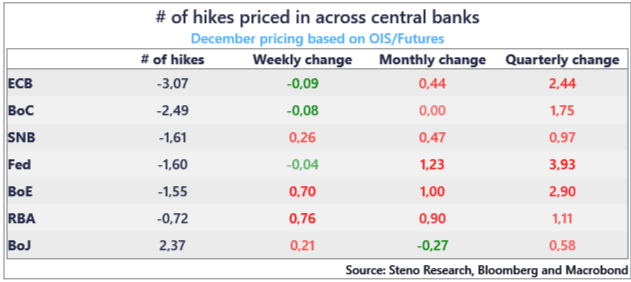

We are now down to 1.6 cuts this year from the Fed, down almost 4 cuts compared to 3 months ago and down 1.25 cuts on the month. Markets have had a hard time giving up the über dovish view on the Fed that risk-assets have enjoyed since the start of the year, but with Powell cementing the higher inflation for a longer narrative yesterday, it seems like markets have started to get the message.

The problem now becomes how the ECB are going to deal with their plans of cutting rates in June. Judging by inflation dynamics, there are plenty of reasons why the ECB could have cut rates already (and maybe they should have), but it looks like they have tried to wait for the Fed to start the cutting cycle before committing, which is off the table now. With the ECB’s track record in planning and forecasting inflationary pressures, it will likely not end pretty when they also have to handle the interest rate spread when they cut rates, as they will find themselves in the driver’s seat for the first time in this cycle.

The recent U-turn in rates pricing now places the Fed and BoE at the bottom of the table after a slightly hawkish surprise in UK CPI this morning, while the ECB and BoC are the most dovish Western central banks.

Chart 1: Central bank december pricing

Everything will be about central bank divergences going forward, as the Fed is looking to hold rates steady while ECB prepares to cut. How will it affect allocations, and what should you look out for in markets the next couple of weeks? Find out here.

0 Comments