Positioning Watch – Volatility is back, but markets still lean into USD duration.. God knows why..

Hi everyone, and welcome back to our weekly positioning / sentiment overview, which will be delivered to you right as firefighters have hopefully put out the fire at the old exchange building in Copenhagen..

Markets have started the week off where they left last week, with the USD wrecking ball continuing to prevail, posing headwinds for equity and fixed income markets as Fed pricing has more or less turned upside down lately. We generally positioned for this repricing of USD fixed income, but were caught wrongfooted in a few trades along the way admittedly.

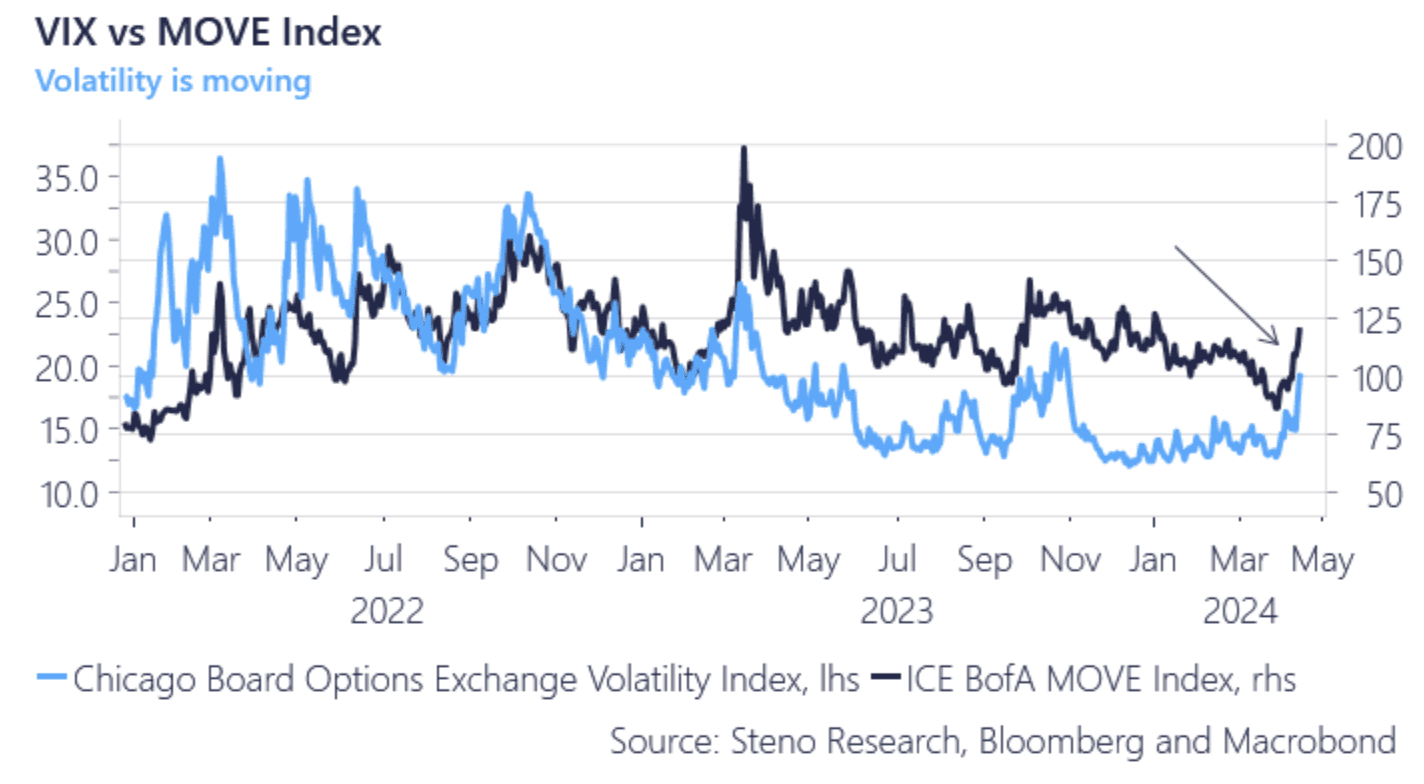

This has allowed volatility to creep back in equity space, as option and swap markets are starting to price in a larger outcome space over the coming months. The cocktail of weak treasury auctions and a more hawkish Fed pricing has kickstarted the revival of the VIX and MOVE index with a sharp swing to the upside over the past week, and even FX volatility is coming back after months of extremely low volatility.

The comeback for volatility is not a truly bearish sign yet, and rather just a sign that markets are normalizing after a crazy 5-6 months where almost everyone was zoomed in on the soft landing, left blindsided to the fact that the world is not binary. Probably healthy if the bull-run has to continue, and our sentiment model is now back to scratch, meaning that equity positioning is not as crowded anymore, leaving room for earnings to drag equities higher.

1st chart of the week: Volatility is back!

Volatility was more or less muted in the beginning of the year, but the cocktail of less dovish statements from Fed officials, strong economic data and the USD wreckingball has sent volatility in the other direction. Has it moved positioning? Not really, but that doesn’t mean that it’s not important.

0 Comments