5 Things We Watch (In China) – Stimuli, USD vs CNY, Liquidity & PBoC

We’ll as always be short and concise and let you into our thinking regarding asset allocation and positioning ahead of the data/events mentioned. We link to our in-depth takes on each of the subject matters in the headline of the paragraph.

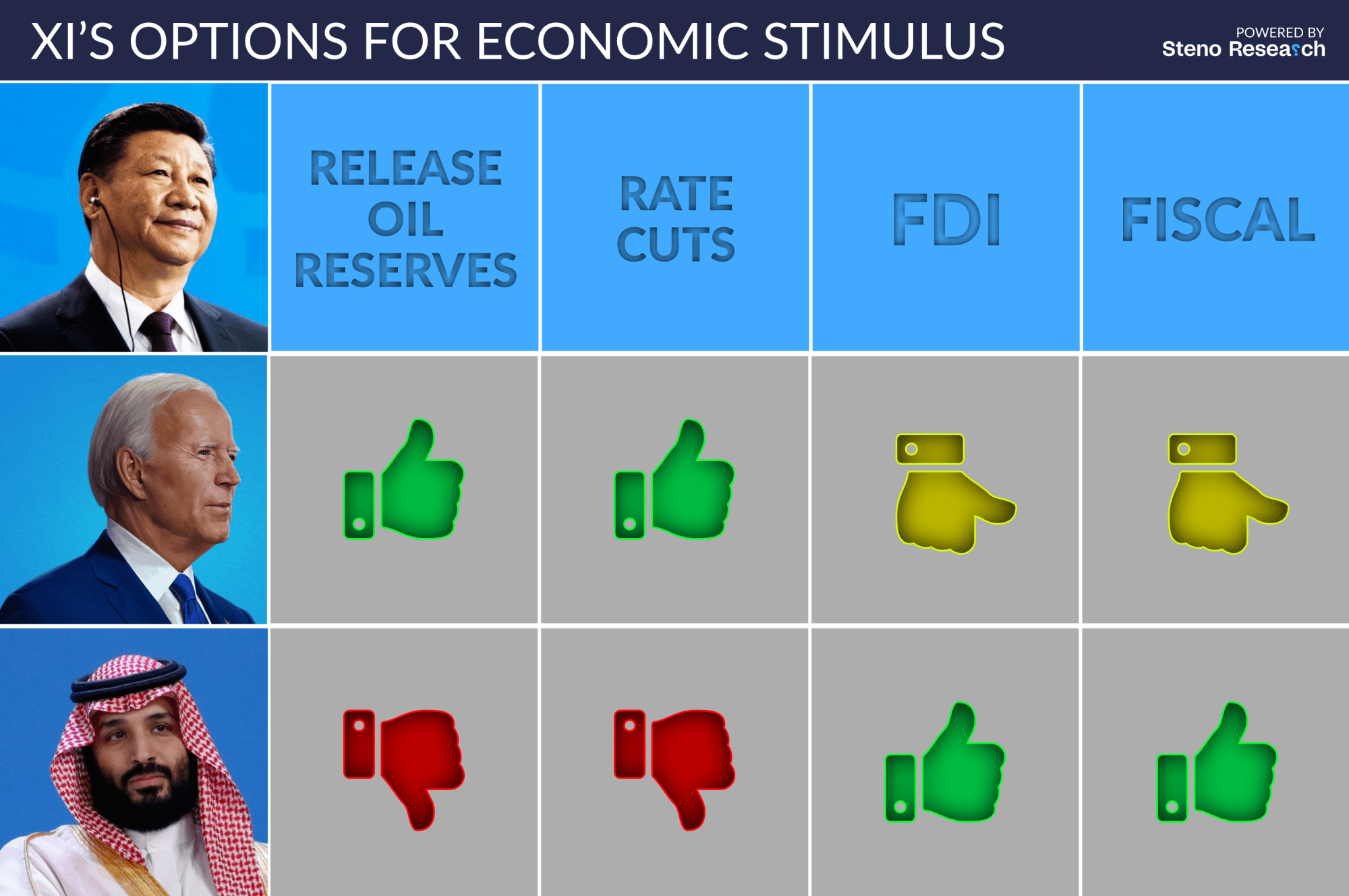

The Chinese economy’s sluggishness calls for implementing measures to stimulate. We see 4 measures with the potential for helping the wobbly economy with different reactions from Biden and Xi’s new found friend MBS.They are releasing oil reserves, rate cuts (already happening), getting FDI inflows back going and fiscal stimulus.

First option would be to follow the Biden playbook and release oil reserves to get manufacturing back going. This would add deflationary pressures to the commodity markets and be welcomed by Biden and loathed by MBS as it would force him to further OPEC cuts if he wants a stable oil price. The same goes for rate cuts as it would strengthen the USD and make the selling of crude oil conducted in USD more expensive. Again, good for Biden and bad for MBS. Option 3 is FDI inflow which is a yuuuuge driver for CNY strength and sales growth in Chinese listed companies. This would be the first scenario in which MBS is happy as the FDI inflows appreciate the CNY and is generally a sign of global synchronized growth. Biggest problem with this option is of course that Xi has spent the last 2-3 years making China almost uninvestable with erratic decisions such as tech crackdowns and locking entire cities down due to COVID measures. It will take a lot to gain the trust of the market again in this regard. Last fiscal option we’ll use a whole thing to address below

Welcome back to our Wednesday series where we take you through the world of global macro and what to look out for going forward. Since we have not covered much else than China this week and the fact that it remains one of the key macro stories we thought we would exclusively zoom in on 5 things we watch related to China.

0 Comments