5 Things We Watch – Cyclicals, Baltimore Bridge, ECB, USDJPY & Sentiment

Loads of stuff are going on in Global Macro, with global equities on the rise yet again, the JPY struggling a bit after unsuccessful attempts from policymakers, including the verbal FX intervention from MoF and BoJ today, and the Spanish HICP numbers, which we hit right on the mark! The benign base effects and dovish outlook has potentially paved the way for a cut in June, but what should you look out for in the meantime? We give you 5 topics from our watchlist.

This week we are watching out for the following 5 topics within global macro:

- Cyclicals

- Baltimore Bridge

- ECB

- USDJPY

- Sentiment

1) Cyclicals getting ahead of themselves?

There is currently no way to stop markets on its tracks towards new ATHs, with inflationary pressures disappearing from the markets’ memory right as liquidity and growth start picking up momentum.

While we lean bullish on equities overall, the latest movements in equity markets should leave every investor cautious for the performance ahead, with positioning starting to get a little too stretched to our taste in corners of the USD market.

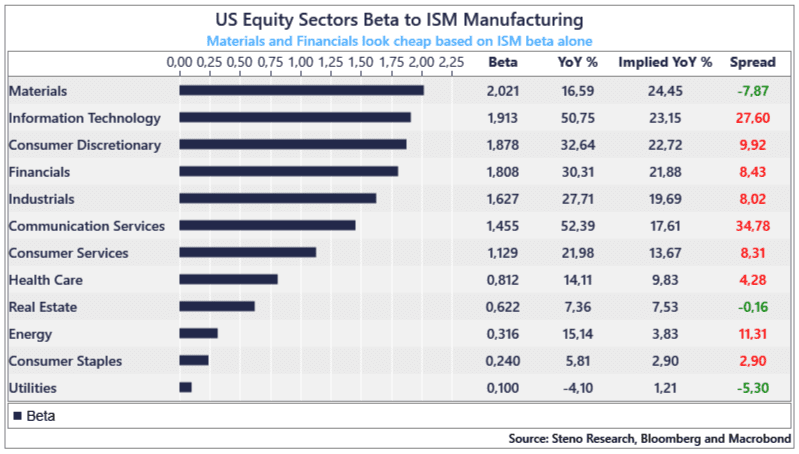

We were relatively early on the cyclical rebound, and when we first toured with the chart below, which shows US Equity Sector’s beta to ISM Manufacturing and the implied performance based on the change in ISM Manufacturing, 8/12 sectors were trading at a discount relative to the cycle.

Now, only 3 sectors trade at a discount, while the rest trades at solid premiums, signaling that the market has probably been frontrunning the cyclical momentum too much – the cyclicals/defensives ratio, which has a neat correlation to manufacturing PMIs is currently trading at value corresponding to 57-58 readings in PMIs.. This conclusion also partially holds true for Germany, which is trading at a 3-4 std-dev premium to our PCA-models. We will elaborate more and consider adding some anti risk-on trades in our portfolio through April.

Chart 1: US Equities went from cheap to expensive relative to the cycle

Markets continue to celebrate what looks to be a perfect landing, while BoJ is seemingly preparing an answer to the post-hike weakness in JPY. Read about the other 3 things we watch this week here.

0 Comments