Positioning Watch – Time to get out of the cyclical trade?

Hello everyone, and welcome back to our weekly positioning watch!

The weather in Copenhagen is sunny, and so is the mood in markets, with aggregate equity fund flows in the US reaching 2-year highs this week. Markets are certainly back into full risk-on mode, with the Fed promising rate cuts amidst reflationary trends in the US, which is a trend that is slowly but surely spreading to the rest of the world. The cyclical rebound is not truly there yet in Europe, which means that European indices are starting to get flagged as overpriced in our quant-models.

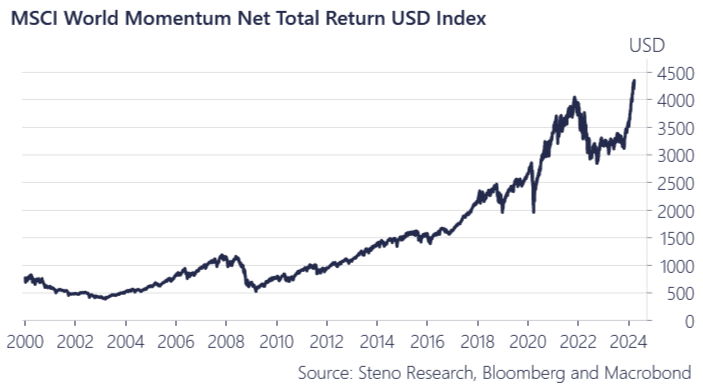

However, be careful out there: Momentum-strategies are off to their best start ever! Betting against the trend will likely be costly, and therefore we await price action to get involved on the short-side in European equities for example, while we remain long in various cyclical proxies in both US and Korean equity markets.

Chart of the week: Momentum is still king

We called out the cyclical rotation a couple of weeks ago, and while our trades have performed according to plan, we are starting to see signs of the trade getting too crowded to our taste.

0 Comments