5 things we watch: Consumer Spending, Seasonality, China, Earnings and Tesla

Happy Wednesday and welcome to this week’s edition of the ‘5 things we watch’ series.

Everything in global macro looks set for a consumption rebound due to inflation-linked technicalities in January. This will make H1 look stronger than feared and lead to a worse than feared H2.

This generally means that you want to be long cyclical stuff and short/neutral on bonds globally for the time being.

We like our curve flatteners, consumer discretionary longs and industrial metals positions accordingly.

This week we’ll try to uncover the following 5 pressing questions captivating macro:

- Consumer spending boosted by inflation technicalities

- Seasonality is not adjusted for due to high inflation

- China is now officially OPEN

- Earnings do better than feared

- Tesla to boom again?

Consumer spending boosted by inflation technicalities

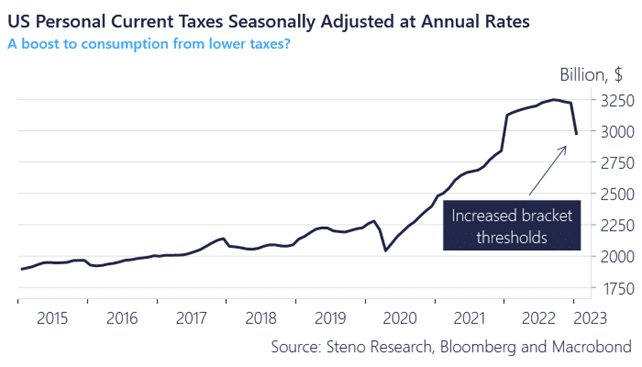

The boost to consumption in January has been a puzzle to many, but it actually makes sense if we look at the some of the underlying technical drivers of consumption. Bracket thresholds for federal personal income taxation levels have been increased markedly (due to inflation) in the US, meaning that the overall nominal taxation has been lowered markedly.

This has released around 250bn USDs worth of spending power annually from the get-go of 2023. Wages will eventually like play “catch up” to new taxation thresholds, but it is undoubtedly a short-term booster to consumption.

Chart 1. Fewer taxes, more consumption!

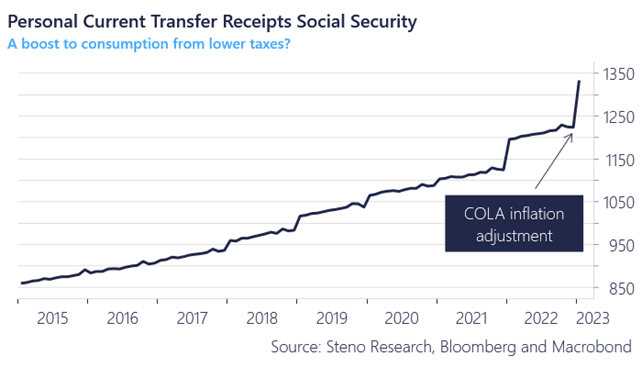

The yearly “COLA” inflation adjustment to social security benefits will add another 100bn to spending power after an 8.7% adjustment in January. This will be paid out to people with a high propensity to spend, why this arguably is another booster to short-term consumption in the US.

The yearly “COLA” inflation adjustment to social security benefits will add another 100bn to spending power after an 8.7% adjustment in January. This will be paid out to people with a high propensity to spend, why this arguably is another booster to short-term consumption in the US.

Tax reductions paired with inflation-adjustments to benefits have in total added around 350bn to the spending power on an annualized basis in January, which translated to a increase to personal disposable income of 2.5-3% in the US.

The consumer is back, and it will be felt in numbers this spring.

Chart 2. Transfer receipts got a nice little 8.7% boost in January

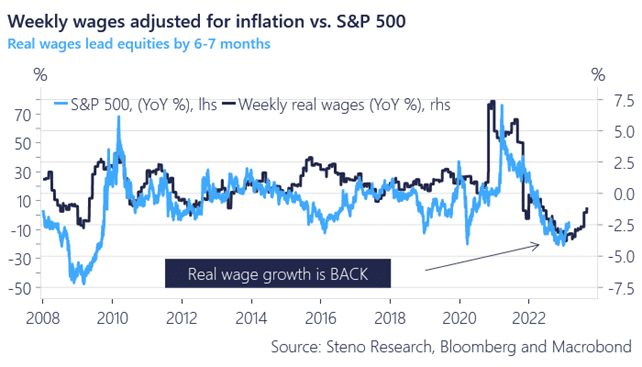

This renewed boost to spending is obviously bad news for hopes of bringing inflation down, but where I disagree with the doom-crowd is on the ramifications for global markets. If the spending power is UP, which it arguably is so far in 2023, it ought to be goods news for equities and risk appetite.

Increased tax thresholds and inflation adjustments to benefits are both to be characterized as federally fueled boosts to consumption, which are not going to increase the cost base of companies short-term and hence this is likely good news for earnings. Not bad.

Chart 3. Real wages up, equities up?

Some of these trends were noticed by the great Bob Elliot of CIO Unlimited Funds on Twitter as well. If you do not follow Bob already, I can only strongly recommend you do it immediately.

The consumer is rebounding fast due to several inflation-linked technicalities in January, while China is now obviously open for business. This should be fuel for equities despite all the bear-porn out there, but also worrying from an inflation perspective.

0 Comments