Steno Signals #95 – Is the next move a hike?

Before getting to the financial word, I just briefly want to reiterate that we find a de-escalation most likely between Iran and Israel after the events unfolding over the weekend. Our head of geopolitics, Mikkel Rosenvold, released his take earlier here.

Quote of the week:

Iran’s Chief of Staff: “Our attack is over, and we do not wish to continue it, but we will respond forcefully if Israel targets our interests. Israel crossed red lines by targeting our consulate in Damascus, and it had to be responded”

This is a tit for tat communication via missiles and Iran using theatrical force. There is no major escalation risk in the rhetoric on either side, except through the lens of those incentivized to blow things out of proportion.

The ongoing events will obviously impact commodity markets both in metals- and energy space, and we are getting increasingly worried about the ramifications for the global inflation pressure.

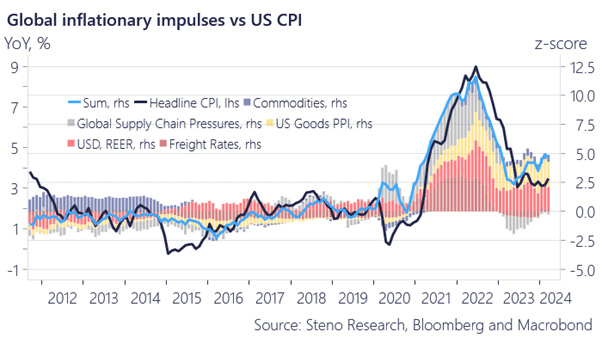

Our proprietary global inflation impulse index has surged back, registering an aggregate Z-score of almost 5. This indicates a substantial positive inflation impulse from each of our five key subcomponents, often resulting in US inflation levels averaging around 4-4.5% after a while.

Chart 1: Global Inflation Impulse Barometer versus US inflation

The market keeps lagging in this re-inflation cycle and while forward pricing and economists are backpaddling on 2024 expectations, the next battlefield is 2025. Could the Fed hike after the election?

0 Comments