US Policy Watch: Speakership chaos and IRA explained

The U.S. House of Representatives woke up this morning to the 22nd day without a Speaker. 4 nominees have come and gone, and today it is junior Rep. Mike Johnson’s turn to prove that he can rally 217 Republican representatives behind him – a big question mark. With a Speakerless house, neither Biden’s $100 billion foreign aid package to Israel, Ukraine and Taiwan nor appropriations negotiations can continue. As a reminder, the U.S government will shut down November 17th if a full Congress doesn’t pass 12 individual budget laws – or so-called appropriations – or adopt another Continuing Resolution (CR) that would extend the FY23 budget. A new CR is hard to imagine given that the GOP lost their former Speaker, Kevin McCarthy, after the first CR was passed. The U.S federal debt has undoubtedly featured heavily in the closed-door Speaker negotiations in the Republican Caucus. Cutting the nation’s $33 trillion dollar debt is a big priority among the far-right members of the GOP who ousted McCarthy – members who want promises heading into budget negotiations.

Getting rid of climate provisions under Biden’s 2022 Inflation Reduction Act (IRA) is an uncontroversial proposal to a large part of the Republican Caucus. At its adoption, both the White House and independent analysts estimated that the IRA would cut the deficit by $300 billion over a decade due to increased tax revenue from cleantech investments and closing taxpayer loopholes with a $80 billion infusion to the cash-strapped IRS.

Since then, the White House has had to adjust expectations on the inflationary effects of the Inflation Reduction Act: “Originally, this was supposed to be a deficit reducer, but now it has flipped. Instead of reducing the debt, it will add to it,” said Kent Smetters, the faculty director of the Penn Wharton Budget Model. According to the University of Pennsylvania Institute, the IRA will add $750 billion to the deficit in the next decade. According to the White House, their estimates are more promising but agree that deficit cuts won’t arrive until year eight or nine instead of four or five which had previously been suggested.

The debate around the IRA’s deficit-reducing effects stems from ongoing uncertainties about how much the IRA is going to cost long term.

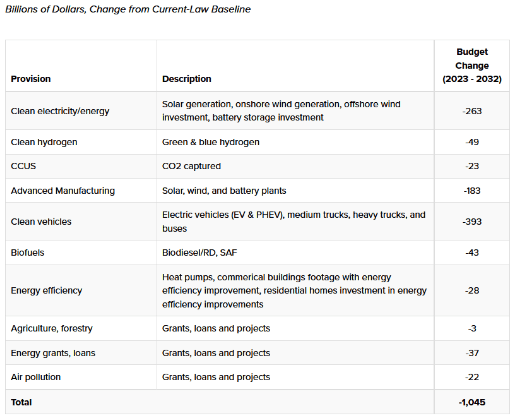

In April, the University of Pennsylvania’s Warton Budget Model (PWBM) updated its budgetary cost for the climate provisions in the Inflation Reduction Act. Previously PWBM reported that climate provisions in the IRA would cost $384.9 billion over 10 years (FY2022 – 2031). This estimate has almost tripled to $1,045 billion.

Why? Because businesses have responded to Biden’s massive supply-side incentives. EV manufacturers have been the most diligent users of the green tax credits under the IRA: 43.51% of clean tech projects announced after the adaptation of the IRA is made in the EV sector. Tesla reduced its prices overnight to make vehicles eligible for IRA tax breaks. In December last year, it was decided that also European carmakers could apply for IRA tax credits to avoid a looming trade war between Washington and Brussels. All initiatives that have made IRA’s budget for EV credits balloon.

Chart 1: 10-Year Budget Estimate of Climate and Energy Provisions in the 2022 Inflation Reduction Act , Wharton

US Politics is in a state of gridlock. We give our latest view on the affairs on Capitol Hill below

0 Comments