The Energy Cable #41: There is something rotten in the state of EIA

Welcome to this week’s energy cable. In this edition, we will delve into last week’s EIA report and provide insights into the natural gas market. In the near future, we will continue to closely monitor the developing situation in Israel and Gaza, with a keen focus on their potential impact on commodity prices in the days ahead.

Steno Research – There is something rotten in the state of EIA

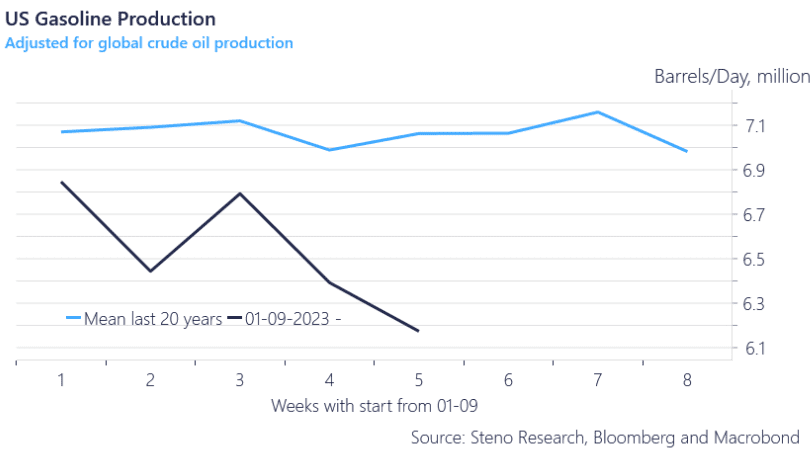

We’ll start this week’s energy cable by talking about the implied demand numbers which were published by the EIA this week. On the face of it, the numbers indeed looked abysmal with production down almost 800.000 barrels/day compared to the mean production of the last 20 years. However, remember these are implied numbers so we need some perspective.

Chart 1: On the face a shocking gasoline production number

Was the entire price drop in the oil price driven by EIA data on flawed assumptions? Will the renewed turmoil in the Middle East revive the oil bet and is the Natural Gas market the new market to watch as an energy bull? Here is your weekly letter on the subjects.

0 Comments