The Energy Cable #40 – Time to follow crack spreads!

3Fourteen Research: Cracks forming

“The test of a first rate intelligence is to be able to hold two opposed ideas in the mind and still retain the ability to function.” F. Scott Fitzgerald

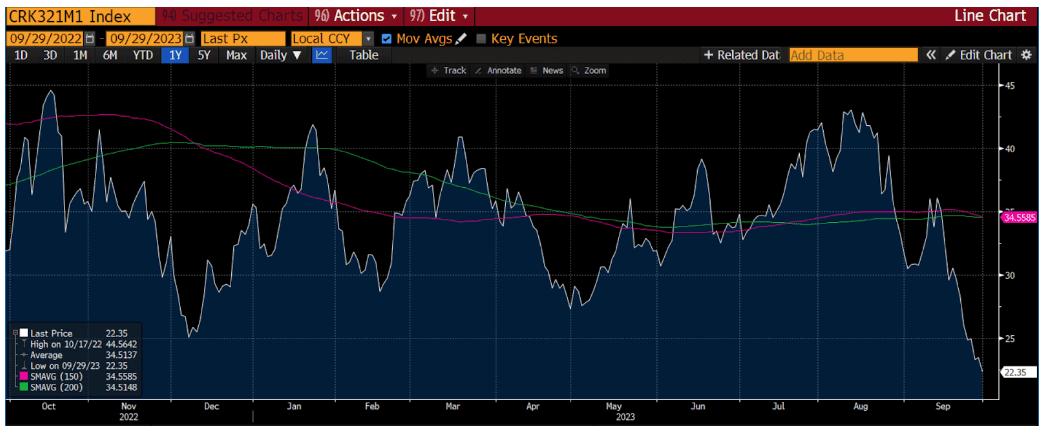

Cracks are forming in the oil market. More specifically, cracks spreads are plunging. Below, we plot the front month 3-2-1 crack spread traded on the NYMEX. Crack spreads are theoretical approximations of refining margins. The 3-2-1 measures the spread gained by buying 3 barrels of crude oil and producing 2 barrels of gasoline + one barrel of diesel/heating oil (hence the “3-2-1” label). Since peaking out above $40/bbl in mid-August, domestic cracks have plummeted to an 18-month low.

A rising discrepancy between crack spreads in Gasoline and Diesel space is worth noting as we move our attention away from oil to other parts of the energy space to find decent risk/reward.

0 Comments