The Energy Cable #39: A Maturing Bull Market

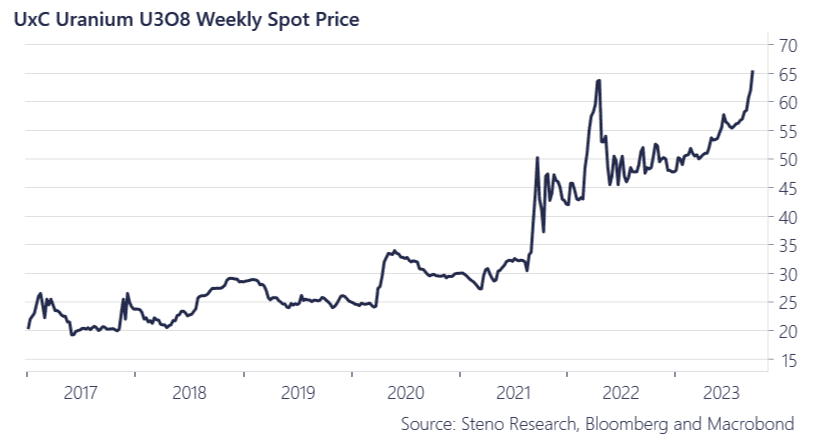

We start this week’s Energy Cable off where we left it last week with a look at uranium. Just as is the case with oil the uranium story is largely a supply side story. Supply is very tight because most suppliers are sold out due to long term contracts. This means that very small volumes in the spot market can make prices go up and down. But why buy now, if the nuclear story is 5-10 years out? Well if you don’t secure uranium now then a utility company might end up with a multi billion dollar asset that is no good so fuel has to be secured. That’s why people rush in to get their hands on uranium now.

One player who has taken advantage of the wild uranium month is Sprott Uranium Trust who last week raised money without buying any uranium which is now creating a quasi floor under spot uranium. Sprott sits with USD 59.7m in cash in their balance sheet while trading just with a slight premium to NAV. As mentioned above the big spot sellers are moving to long term contracts instead of being in the spot market. This means less U308 available for spot selling and when utilities have to spot buy the market becomes tight and so very simply with a tighter spot market you need less money to create a floor.

Chart 1: Tight spot market squeezes uranium higher

Is the oil bull market about to become old hat? We are turning our attention to Natural Gas and Uranium to find value in energy markets. Find out why here!

0 Comments