Spending Watch: Looking into the balance sheet of US Households

It has been a while since we last discussed the state of the consumer. While we see plenty of stress in the financial economy- banks, duration assets and debt, consumers have yet to capitulate. The root cause of recent financial stress is of course the ongoing monetary tightening, which in turn is a result of the liquidity in the economy and the consumers spending it. While Powell is off with the vacuum he did throw quite a party along with Washington’s easy policies. So how are the consumers faring? The data suggests that they’re fine for now and that their balance sheets are healthy, but what is the outlook?

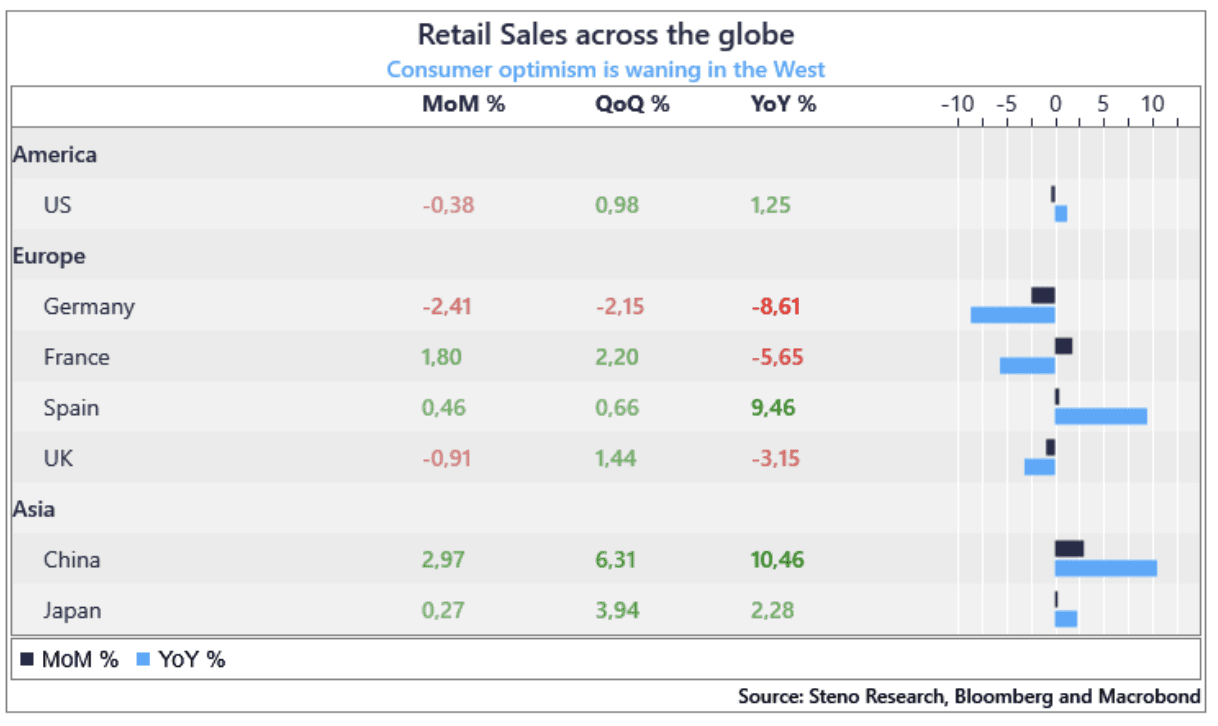

Retail Sales recently started to look weaker than anticipated by many, and both US, UK and especially Germany are suffering at the moment, which might lead people to believe that consumer conditions have started to weaken – actually, they have not.

Chart 1: Retail Sales have started to look weak in the West

Despite all the recession talks and worsening economic conditions, consumers seem to be fine (for now), which might disturb our thesis of lower inflation and a recession in H2. In this piece, we’ll shed some light on the household balance sheet and deduce what it means for macro the next couple of months

0 Comments