SLOOS Survey: The US economy is re-accelerating and money growth is back!

The demand- and supply for money has bottomed out! That is the overwhelming conclusion from the quarterly survey on banking standards released by the Fed.

Here is our findings in headlines:

– The SLOOS improves further from Q4 to Q1, and especially the supply side has eased quite a bit and is almost back in neutral territory

– The rebound in demand is underwhelming, but it also typically lags supply/financial conditions by another quarter, meaning that Q2 is the likely big rebound in loan demand

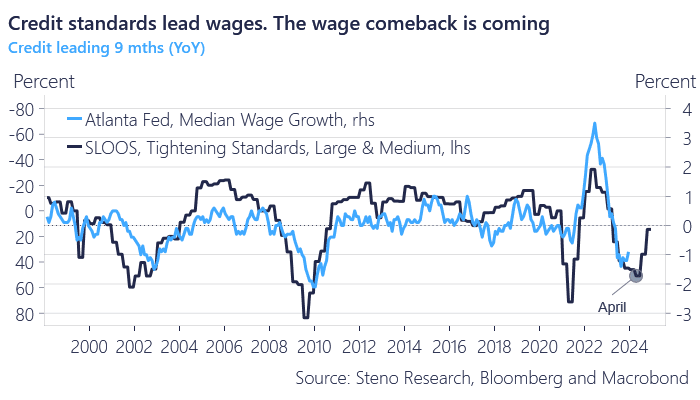

– The SLOOS leads wage growth by 6-9 months and empirically the wage-growth will re-accelerate from roughly April and onwards again. Inflation is likely going to return with a vengeance.

– If the Fed cuts in May, they will end up cutting straight into a cyclical upswing. There may be sound reasons to do so, but that is the conclusion for now.

Chart: Wage growth to re-accelerate during the spring. Inflation to return?

Is inflation going to re-accelerate? The bottom is in for the SLOOS survey, which tends to be a strong cyclical indicator in the US economy.

0 Comments