Shipping Watch: Looks like container rates have topped for now

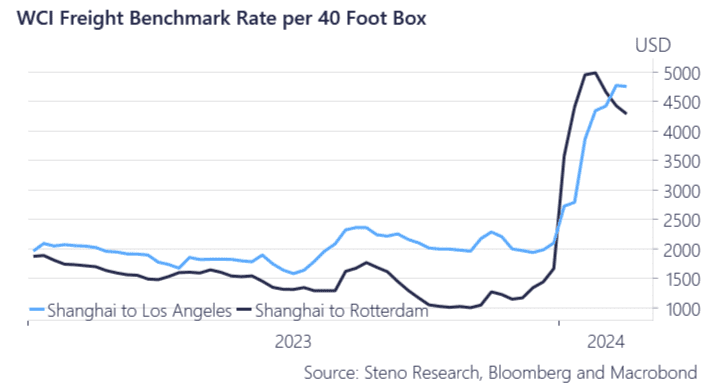

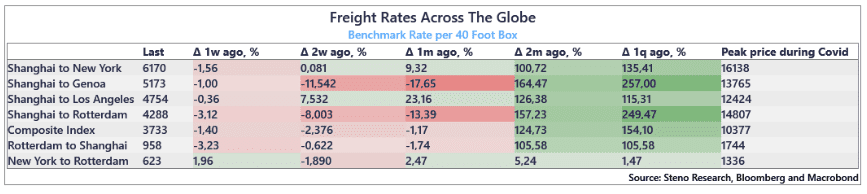

The latest data release from WCI shows the first w/w drop in US freight rates in a couple of months. Meanwhile Europe continues its drop in freight rates for the 3rd consecutive week now. Looks like the carnage in freight rates is over with seasonal effects in shipping expected to kick in 1-2 months from now based on historic import patterns from Europe and the US. Without a resolved situation in the Red Sea, the freight rates might flare up in late March/April.

Speaking of US consumption, the news yesterday broke that the Port of LA started off the year with near-record volume only eclipsed by 2022 driven in part by strong consumer spending. It seems like the divergence we are seeing between US and European 40-freight rates is likely to continue for now. The data point is also a clear indication that the US consumer is in a much better place than European dittos. Expect seasonality in the US to affect freight rates more than in Europe.

Lastly we note that container ship crossings in the Red Sea are nowhere near looking like they are rebounding hence why we see the drop in rates as a product of a demand question.

Chart 1.a: Latest WCI freight rate show US rate plateauing

Chart 1.b: 1 w/w drop in US freight rates in months

Container rates have peaked for now, but without progress in the Red Sea, there is a risk of a return of higher rates by the spring-time. The damage for US inflation has likely already been done, but we see signs of exhaustion in the long energy bet.

0 Comments