Positioning Watch – Long metals positioning is still crowded

Hello everyone, and welcome back to our weekly positioning watch.

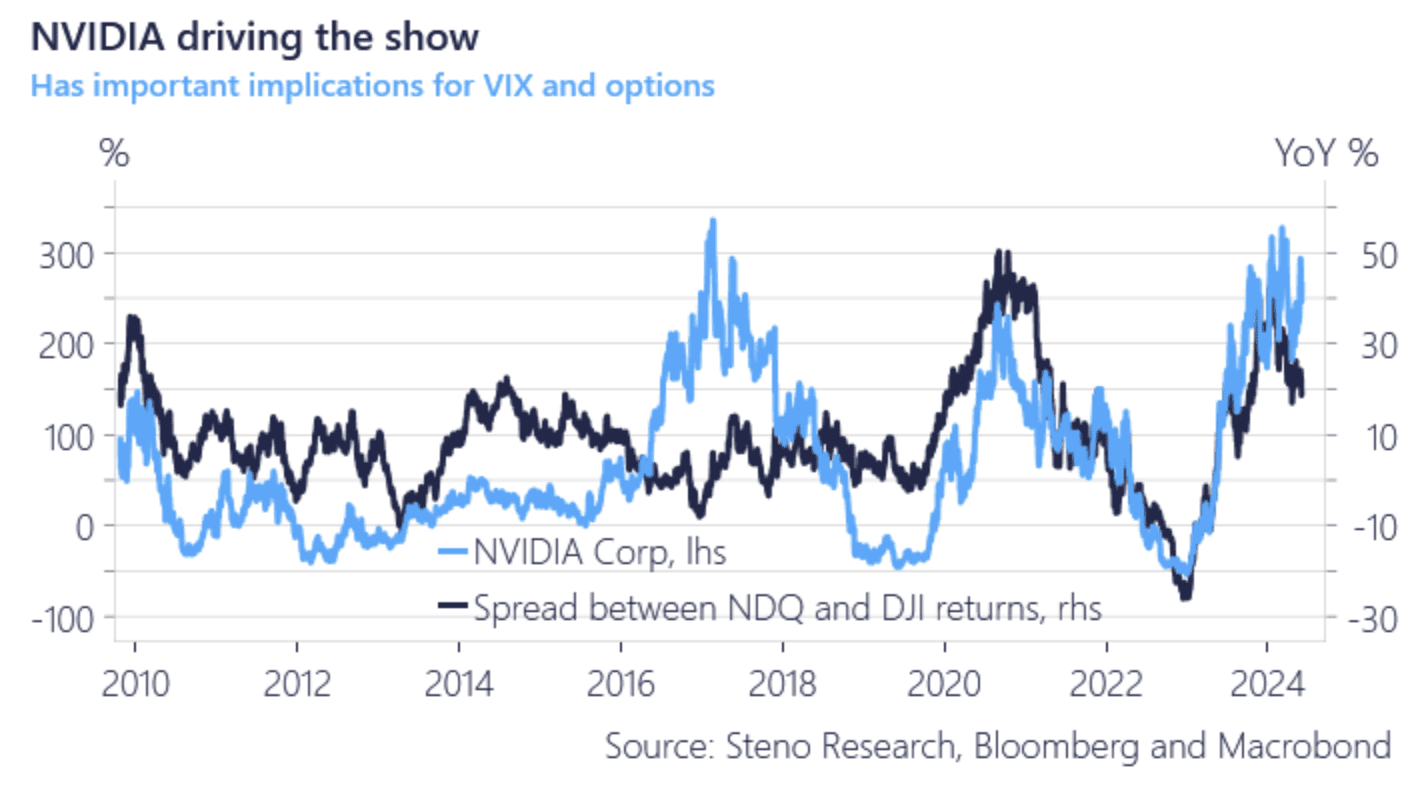

The divergence between market-cap weighted and and non market-cap weighted indices is slowly normalizing, but the impact that NVIDIA (and some of the other big tech firms) has on both broad equity returns is notable with the 5 largest companies in the S&P 500 accounting for roughly 30% of the index by now. This does not only have implications for the distribution of returns between bigger indices (Nasdaq vs Dow Jones for instance), but also on indices option volatility, with the VIX ex NVIDIA hitting lows of around 9 in May (2017/2018 lows). A LOT of financial modeling will be impacted by this, as both the VIX and indices metrics are used for an analysis of broad equity positioning and exposure, when in reality indices become less and less broad.

Chart 1: NVIDIA (and other large tech companies) are screwing up your models

The positioning remains crowded in Copper, Gold and Silver (and to a certain extent oil). If economic surprises continue to be soft in the coming week or two, we may get an ugly washout ahead of the July contracts maturing.

0 Comments