Positioning Watch – Steepener bets back on?

Hello everyone, and welcome back to our weekly positioning watch! Hope you all had a great time off during the Easter break.

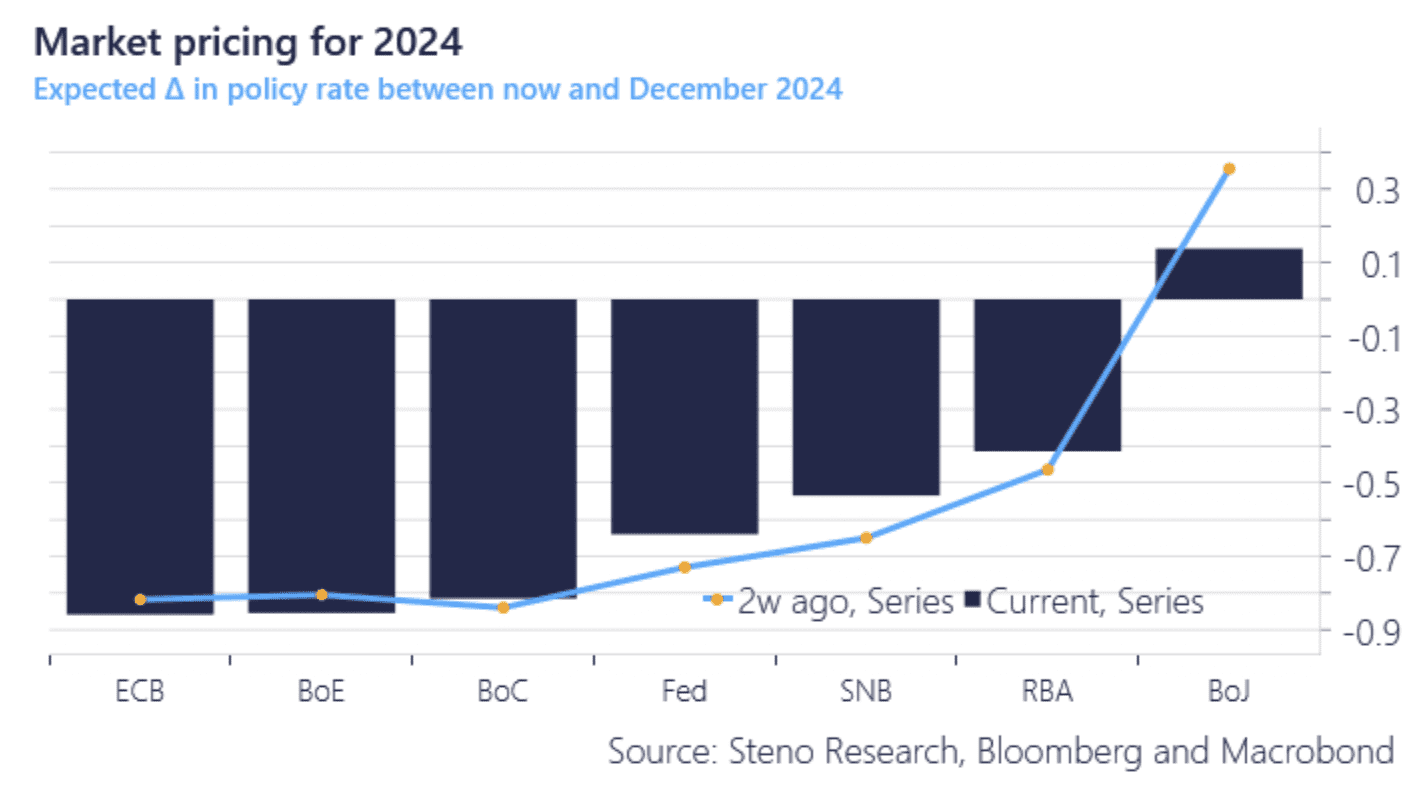

The market narrative has remained more or less intact after the break, with equity sentiment still going strong until today despite a bit of a hiccup delivered from the Fed, with especially Waller but also to a certain extent Powell pushing back on the 3 rate cuts priced in just a couple of weeks ago. The scenario with 0 Fed cuts in 2024 is looking to come into play, right as European central banks have likely received the final evidence for them to start cutting rates, with German CPI surprising on the dovish side, and UK Retail Prices collapsed, paving the way for both BoE and ECB to cut rates before the Fed, which admittedly has a more difficult time battling inflation.

The Fed is now only priced to deliver less than three hikes in 2024, and Japanese have faded a tad… The hawkish BoJ narrative has quickly vanished in FX and rates space it seems?

Chart of the week: BoE and ECB to cut, while Fed holds rates steady?

Manufacturing sensitive assets have generally been outperforming broad-market benchmarks over the past weeks, despite some signs that the manufacturing boom could be short-lived. Some markets have started to agree, lowering exposure in both commodities and cyclical FX.

0 Comments