Positioning Watch: Is the market prepared for a Manufacturing rebound?

We fiercely track positioning here at Steno Research to try and assess whether the risk/reward of taking a view/trade is decent given current market conditions.

In this week’s edition of the positioning watch, we will try and assess whether markets have already positioned for a cyclical uptick in the US economy or not.

Equity positioning: Discrepancy between retail- and institutional positioning still

In equity space, one can make the case that sentiment and positioning have actually turned continuously more upbeat through most parts of 2023, also due to an ultra-bearish starting point in January with everyone and their mother expecting a recession to arrive.

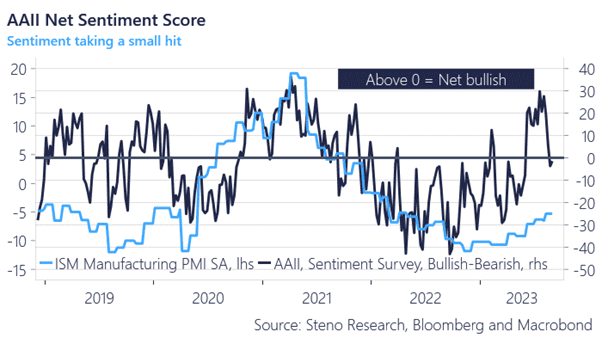

The sentiment among retail investors (AAII) looks a bit lofty/cheerful relative to the underlying change of trend in Manufacturing, while institutional investors remain mostly caught behind benchmarks in risk allocations due to the bearish allocation mix heading into 2023.

The discrepancy between retail and institutional positioning in equities remains intact.

Chart 1: Retail investors have pre-partied ahead of the cyclical rebound, while institutional investors have remained more conservative

There are early signs of manufacturing rebounding in the US amidst weakness in labor markets, weak European growth and yet another Chinese credit event. Is the market prepared for a cyclical uptick in the US despite all of the turmoil? We take a look here.

0 Comments