Positioning Watch – How are Macro Hedge Funds positioned?

Hello everyone, and welcome back to our weekly Positioning Watch – insights into how market participants are positioned.

Markets are waiting patiently for the US CPI report today before placing their bets it seems, with little to no action seen yesterday and in European opening hours yesterday. As elaborated upon in our “Week At a Glance” on Monday, we see hawkish surprises to both headline and core inflation , which will not be good news for markets, who have seemingly returned to their hopes of rate cut(s) this year.

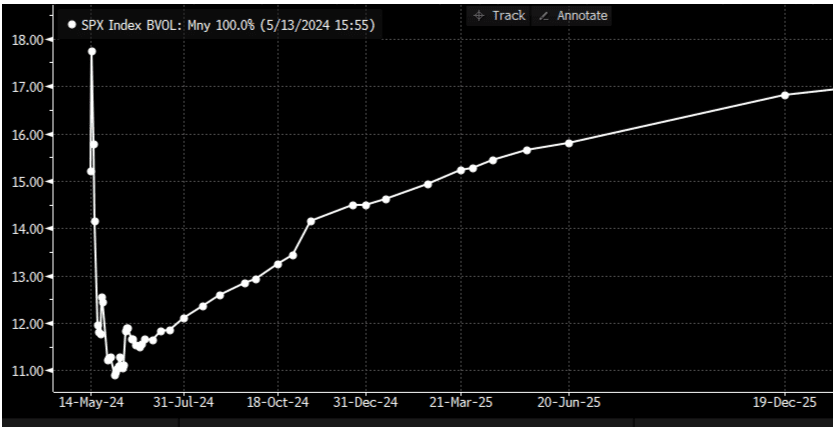

Judging by option volatilities on SPX options, today’s figure is a HUGE event, and option premiums for ATM options expiring this year have skyrocketed, as the release will likely act as a go/no-go for the Fed to cut rates.

Chart of the week: HUGE volatility around today’s CPI release

By taking the rolling beta of various assets to the performance of Global Macro Hedge Funds, we are able to generate an approximation of how macro traders are positioned in this environment. A clue: They are leaning towards a CNY devaluation too, while they are short USD fixed income and long the USD (broadly).

0 Comments