Positioning Watch – Has the sudden change in rates pricing changed positioning?

Happy Monday, and welcome to our weekly positioning update!

Markets seem to be back to normal dynamics, with US indices slowly drifting higher with S&P 500 passing the historic 5000 USD level, despite most economic data prints surprising to the upside, almost forcing risk-asset investors to believe that the economy has survived higher interest rates for good.

Although rates traders have made what looks like a u-turn in the # of cuts priced in for 2024, the promise from central bankers that policy rates will come down has been anchored in expectations, and the cocktail of slightly better than expected economic data and the perception that central bankers will cut interest rates (albeit slightly slower) anyway produces a perfect environment for risk assets to perform and drift higher.

With USD liquidity looking to continue its upward trajectory, equities are still a buy given the current narrative – momentum is king.

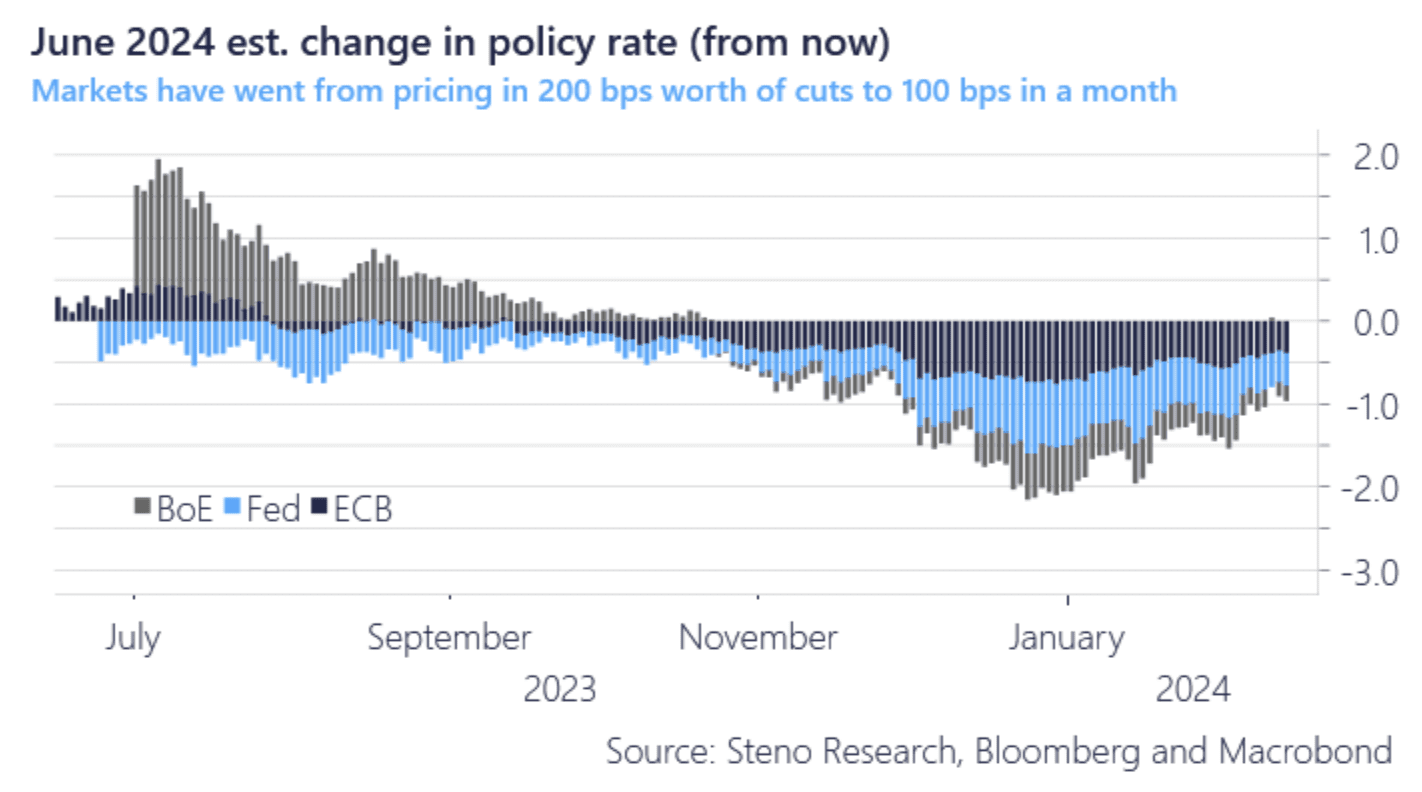

Chart of the week: The date of the first cut is a bit more uncertain now

From 200 bps worth of cuts priced in for June across the big 3 CBs in the start of January to 100 bps now. Does it move the needle or is everybody still on the risk-wagon?

0 Comments