Positioning Watch – Equities are perfectly positioned for a rally towards the election

Hello everyone, and welcome back to our weekly positioning watch.

Equity sentiment has normalized further despite the rather dovish tones coming from Powell last Wednesday, although the rhetoric sounded more indecisive rather than the opposite, meaning that a pause is still not out of scope if the Fed can’t regain control of financial conditions and inflation – and tendencies are pointing in that direction with rent inflation seemingly back again to haunt markets.

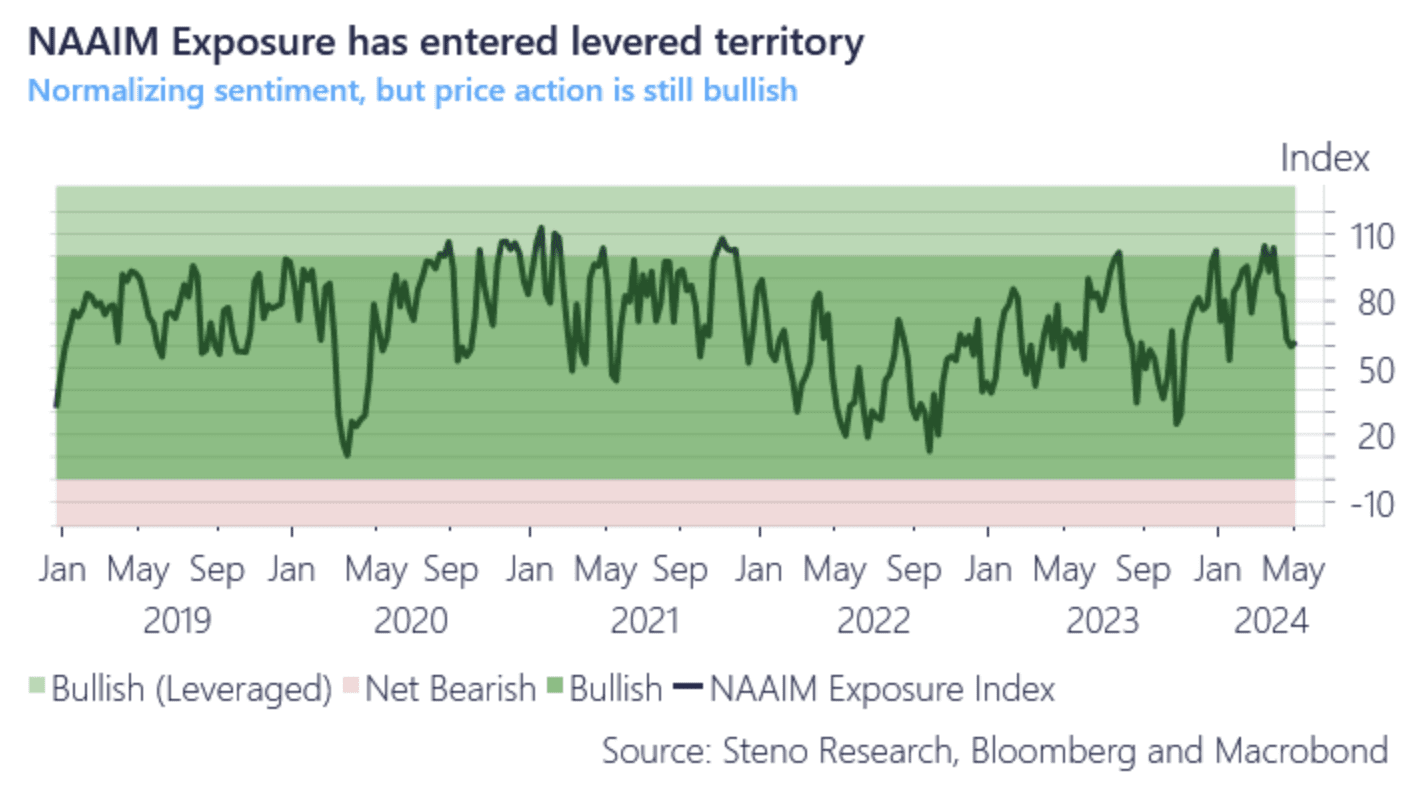

Active managers’ exposure in equities, released through the NAAIM figure has dropped back to around 60, and while it’s still bullish compared to historical standards, it’s much more benign compared to levels seen in Dec 23’ and March/April 24’.

The normalization of stretched positioning comes at the perfect timing for equity bulls, as the announcement of QT to shrink has just been delivered to markets. We’re going to go from a VERY bad April in liquidity terms to a GREAT Q3, potentially setting the scene for a continued equity bull-run that could run towards Q3/Q4.

Chart 1: Normalizing sentiment amongst active managers

The April washout in global equities has reset the über bullish positioning in equities seen pre-April, but that leaves equity positioning more normalized right as liquidity kicks in. Time for further gains in equities? We think so.

0 Comments