Positioning Watch – Commodities are finally moving

Hello everyone, and welcome back to our weekly positioning watch!

We have been all about the possibility of a cyclical rebound with the US economy showing great signs at the moment, and China is also potentially looking to beat the fairly bearish expectations (and why barely anyone has been net long cyclicals in all asset spaces).

This leaves markets with a great divergence, as Europe is yet to show the same signs of momentum, and inflation expectations (between USD and EUR) are also starting to diverge, but positioning has not followed accordingly.

Without further ado, let’s jump straight into the data!

Equities

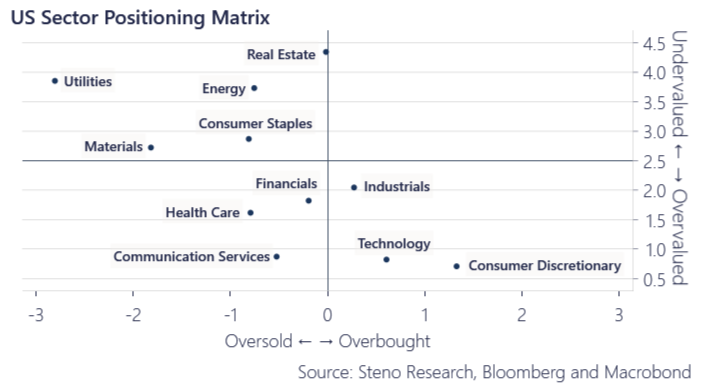

- Our usual positioning matrices are shown below as always. Cyclical equities are still in the attractive undervalued and oversold category, as performance has not been on their side yet. Higher beta sectors like tech and consumer discretionary keep receiving inflows, and despite being flagged as ‘Overvalued’ based on fundamentals, better liquidity conditions and growth will likely give tailwinds to such sectors going forward.

- Markets have slowed down the inflows into US indices, which have traded sideways the past week. Flows are also mostly silent, with modest outflows in Nasdaq and Russell ETFs and barely no inflows into S&P 500 ETFs on a monthly basis.

Chart 1: US Sector Positioning

Commodities positioning have remained fairly silent over the past few weeks, but we are seeing early signs of appetite for cyclical commodities now. Early innings of a cyclical rebound or just noise?

0 Comments