Positioning Watch – 0 Fed cuts is almost the most favored outcome in market pricing now

Hello everyone, and welcome back to our weekly positioning watch, where we as usual will dive into positioning and sentiment data to provide you with the latest overview of crowded trades and where the markets are leaning.

This week we dig into how the rise of volatility (and volatility of volatility) has affected market positioning, if the recent weakness in equities has shaken around positioning (hint: it has) and the recent developments in rates pricing, where the outcome space for the DEC2024 SOFR contract has turned significantly more uniform in hawks’ favor.

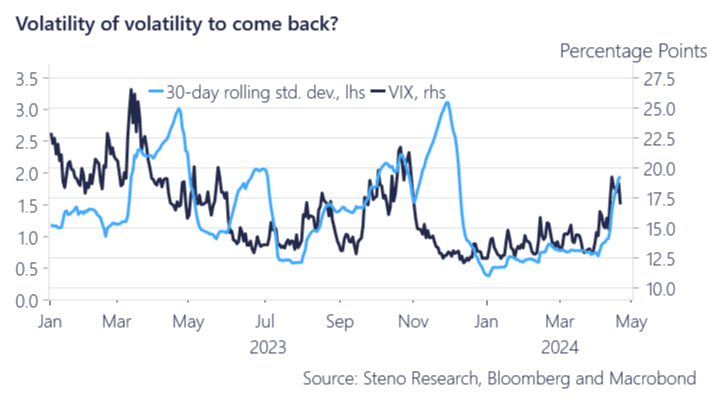

The VIX recently woke up after a long period of being range-bound between 12.5 and 15, surging on the back of weakness in equities as tax payments have been due in April combined with a slightly hotter than expected CPI report and hawkish remarks from Powell. While the VIX looks to retreat a bit these days, volatility of volatility keeps climbing, which will likely be the case for the rest of H1, as economic figures and price data will deliver mixed signals. Worth noting if you are in the market for options..

Chart of the week: While volatility could retreat, volatility of volatility is back

Option-implied probabilities derived from DEC2024 SOFR options show interesting dynamics in Fixed Income sentiment, where rates traders now almost see 0 cuts or even hikes as the most favored outcome by December this year. Read how positioning data has evolved over the last week here.

0 Comments