Portfolio Watch: How to trade increasing USD liquidity?

Welcome to the last edition of the Portfolio Watch of the year.

USD liquidity will likely come flying out the gates of 2024 due to liquidity additions from the BTFP, the ON RRP and the TGA facilities (read more here) and we project a liquidity addition of $800bn+ in Q1.

How will markets react to such a liquidity injection, and does it matter whether the liquidity addition is technical, temporary or outright QE driven?

Let’s have a look.

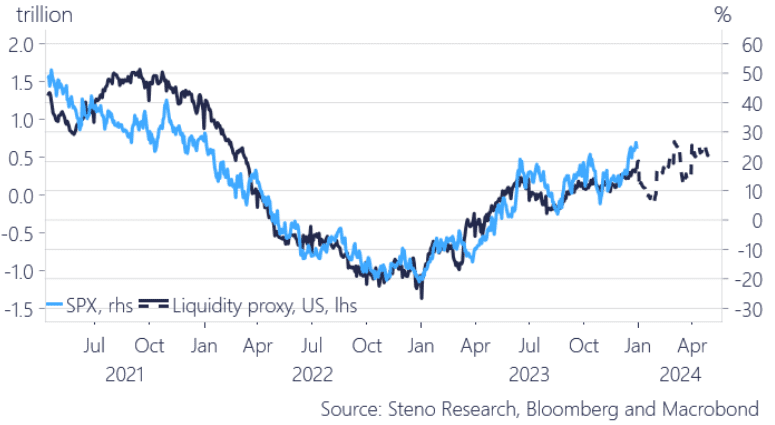

There is a decent correlation between USD liquidity and asset prices, and even if the causality is admittedly somewhat debatable, we find it worthwhile chasing the narrative, as markets consistently do so.

It probably matters whether the liquidity injection is temporary of nature or not. The depletion of the ON RRP is certainly not temporary, while a drawdown of the TGA is of clearer temporary nature, but the net/net picture remains intact – liquidity will increase, also more than temporarily, in Q1.

Chart 1: Correlation between USD liquidity and S&P 500

In this edition of the Portfolio Watch series, we look at sensitivities to USD liquidity across asset classes.

0 Comments