Portfolio Watch – Have markets traded the cyclical rebound in advance?

Welcome to our weekly portfolio watch, which today will be all about the (potential) upcoming rebound in the cyclical momentum. As always we share our trade thoughts and ideas and provide you with our current allocation.

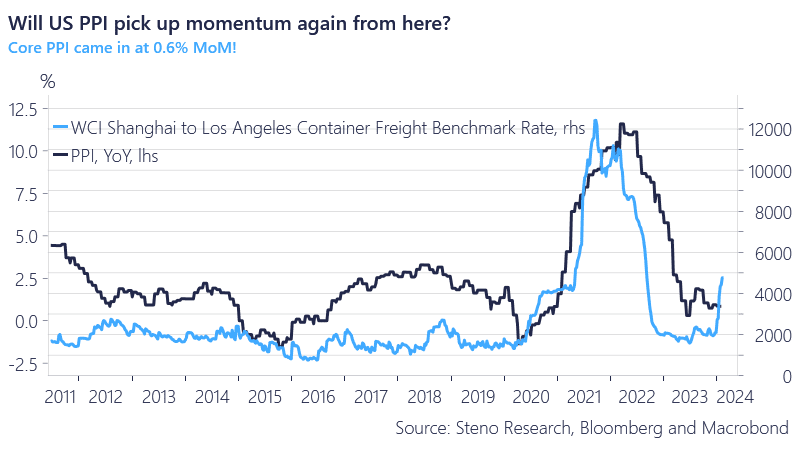

Yesterday’s PPI came in hot as we expected (0.6% MoM in core PPI vs 0.1% expected), which serves as an early sign of a reacceleration in inflationary pressures, which have been our base case since the continuation of the tensions in the Red Sea: It looks like the increase in US freight rates has started to impact producer prices. Remember that US freight rates are still on the rise, while European freight rates have shown what is likely to be a top.

Markets showed interesting dynamics pre-open in the futures market, with Tech outperforming other indices, but that has quickly been reversed with Tech dropping more than S&P 500 for instance. Like with the CPI release, we would expect equities to pick up momentum again given the liquidity outlook paired with Fed’s implicit “promise” to cut rates, which will prevail.

Chart 1: US Freight Rates moving over to input prices

Markets have started to factor in good news as bullish, which all of a sudden makes market pricing (on equities mostly) indicative of economic expectations once again. Are there still opportunities in the cyclical momentum?

0 Comments