Portfolio Watch: Don’t underestimate the US consumer

Welcome to our weekly Portfolio Watch, where we walk you through the most relevant trading topics for our portfolio and yours.

Our bet on the US consumer is off to a flying start. We have generally assumed that we can write off much of the weakness in May data due to severe weather incidents, which reached a 13-year high in May. The weather has been much more benign in June, and we will likely see the first signs of this next week in the non-farm payroll report. This report is expected to be another solid showing if we judge from withheld tax trends in June. Remember, you need a job to see the tax authorities withholding tax—it’s hard to get a better indicator of job growth.

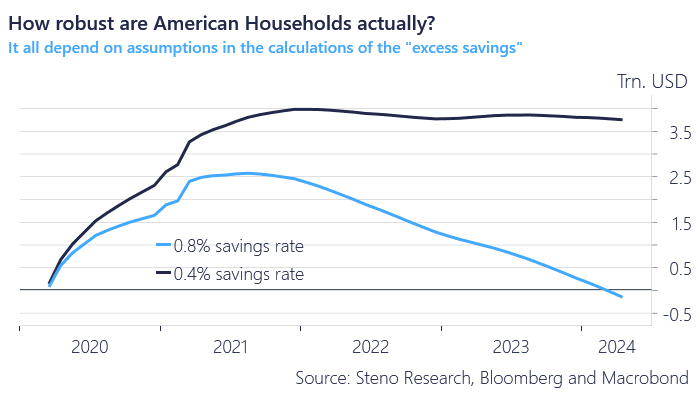

Stories about the depletion of excess savings from US consumers have been plentiful in recent months, but we’d like to challenge the assumptions made by the San Francisco Fed in their recent studies.

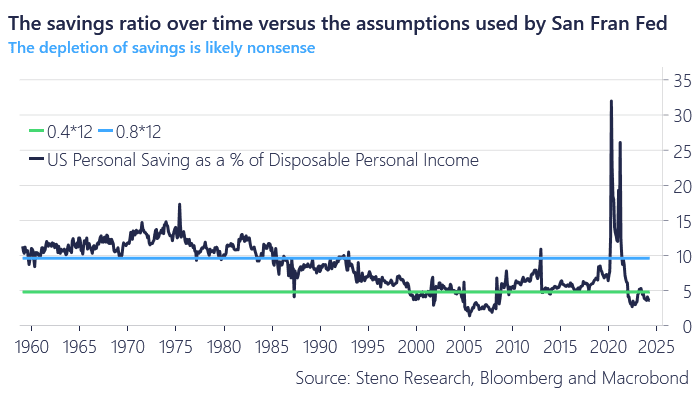

The San Francisco Fed assumes an equilibrium savings ratio of 0.8% a month, which we essentially haven’t seen since the 1980s. This calculation of current monthly savings minus the trends looks oddly violent, which is unfair, to say the least. Given changes in debt markets, interest rate levels, and similar trends, households simply do not need to save almost 10% a year. Assuming a savings rate of 5% a year seems much more plausible, judging from more recent trends. Hilariously, a savings rate of 0.4% a month leads to the conclusion that US households have over $3 trillion worth of excess savings left.

The US consumer is not depleted of resources—quite the contrary. We remain long the US consumer accordingly.

Chart 1a: US excess savings are most likely large still

Chart 1.b: The assumptions made by the San Fran Fed are bizarre

We are off to a flying start in our bets on the US consumer. We consider the “excess savings depletion” narrative vastly overcooked, and find the playing field to have changed leaving consumption solid in the month(s) ahead.

0 Comments