Portfolio Watch: Be our guest to jump the great rotation bandwagon

What a week in markets after the uber-dovish inflation print yesterday, which saw huge rotation within the equity markets as well as action in both FX and commodities. In the equity space, we saw the biggest outperformance of the Russell 2000 against the Nasdaq since early 2021.

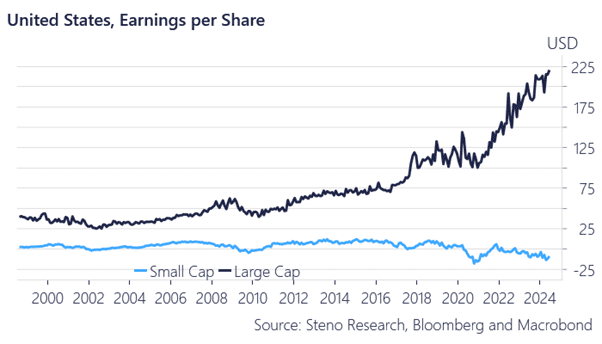

Yesterday’s rotation was driven by hedge funds facing a short squeeze on their small-cap and RE hedges as yields came down. Markets might have been overly bearish in terms of positioning in small caps, but considering earnings, we invite everyone to take a position in US small caps as opposed to large caps.

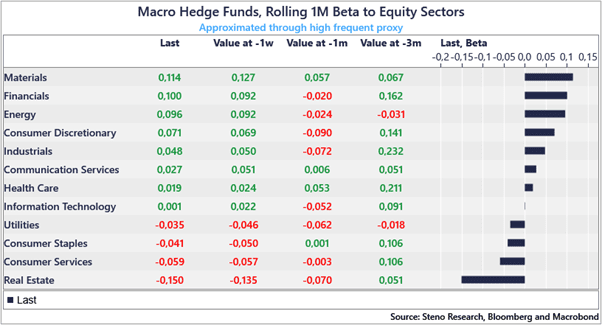

The more interesting rates bet here might be real estate with the labor market looking more like being in normalization than weakening. Based on the data we have gathered, RE and Consumer Discretionary remain the two most shorted sectors (both on an aggregate and on a single name basis). Interestingly, the soft(ish) rates environment paired with lower price inflation in the next few months may be a cocktail that treats both of these sectors well.

We still find the largest empirical positioning (on a net basis) in Materials, Financials, and Energy, which is interesting as those sectors rhyme with reflation. This isn’t exactly what the CPI report indicated

Chart 1.a: Long small caps… be our guest

Chart 1.b: Our high frequent positioning indicator

Chart 1.b: Our high frequent positioning indicator

The PPI serves as a friendly reminder of the cyclical dynamics brewing beneath the surface of the global economy, which contrasts with the current sentiment. We are not convinced of a major slowdown, but we obviously find insurance cuts more likely than a few weeks ago. Here is how to play it..

0 Comments