Portfolio Watch – Adjusting equity and commodity risks as the reflation story stalls

Hello everyone, and welcome back to our weekly portfolio watch, where we shed light on the most important factors driving our Macro and Crypto portfolio over the past week.

Macro Portfolio – Reflation bets have lost momentum

We have been banging the drum on a combination of slightly higher prices and a continuation of the rebound in manufacturing on a more global scale, placing bets in broad commodities and cyclical equities like Materials. The recent rally in BCOM has however been put to a halt over the past week, and it looks like we are in for a smaller correction in industrial metals, where clustering risks have turned more profound in copper and silver especially, as right about everyone has placed longs in the copper July contract.

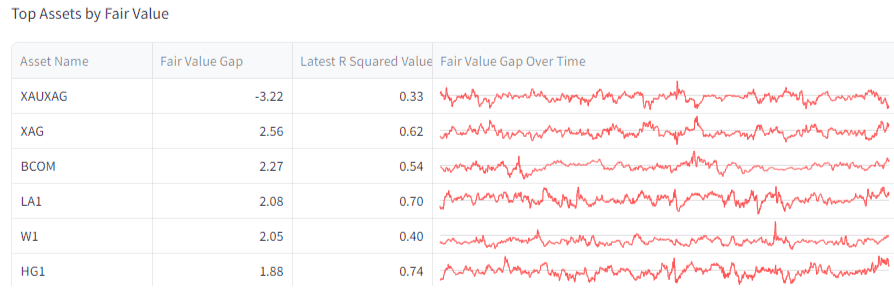

Our PCA-tool has started to flag broader commodities as expensive with a fair value gap of 2.27 std. devs., and there are increasing risks that we will see a move lower in commodities over the next 2 weeks, which speaks against the reflation story.

While the reflation story takes a breather, we hedge the downside of our broad commodity exposure by placing short bets in both copper and silver, which has also been flagged as expensive by our PCA-tool. The copper curve has also normalized substantially compared to 2 weeks ago where the front month was SUPER bid.

To sum up, we are preparing the portfolio for 2-3 weeks where data is going against us, before reflation returns.

Chart 1.a: Fair value gaps in the commodity space

We’re modifying the weighing of risk assets and commodities as the reflation story stalls, whilst the liquidity outlook will turn in early June. Read our portfolio thoughts here.

0 Comments