Out of the Box: 6 reasons the Fed will be hiking rates in 2024

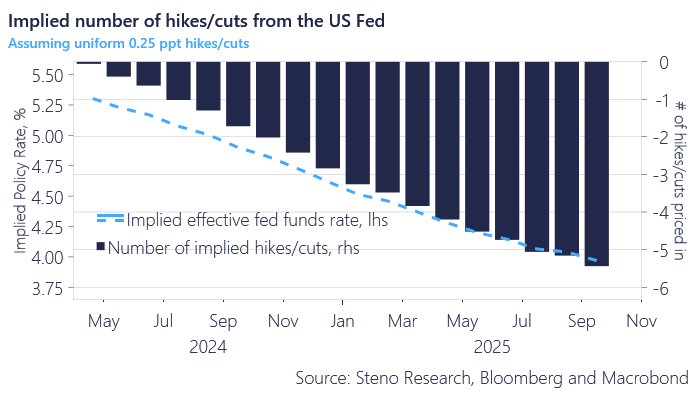

Even though the Santa rally in US STIRS has largely been reversed, markets are still pricing in 2.5 full cuts by the end of this year or so with the first to come around summer time. Currently, one of the most unappreciated risks by markets would be the Fed actually hiking rates in 2024 and thus we thought we would present 6 compelling and thought provoking arguments for why the Fed hiking in 2024 might not be impossible after all (our base case is a hold).

Chart of the week: Fed’s cutting path..

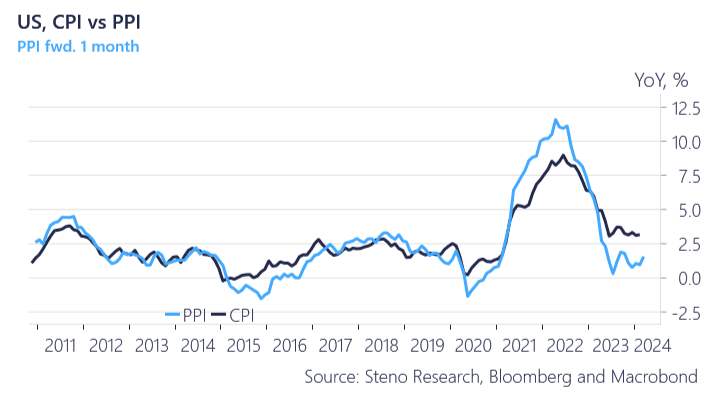

The first argument has to do with year-on-year inflation seemingly having reached its equilibrium at 3%, a range in which it has found itself for the last year or so. If the Fed is hellbent on getting rates back to 2% then 2-3 rate cuts by December seem unnecessary. In light of FOMC member Kashkaris recent comments, it is probably a view that is gaining prominence within the FOMC.

Adding to that, the latest PPI reading suggests a re-acceleration of input prices, which doesn’t rhyme with headline inflation coming down to 2% any time so that gives even greater credence to the hiking thesis.

If we look under the inflation hood we see that it is in particular the OER which keeps core inflation elevated and looking at a live gauge such as Zillow observed rent OER can be expected to back in pre-COVID range sometime during the fall this year. By that time, however, a range of other components might be re-accelerating such as goods inflation via the supply chain pressures we are currently experiencing. And if that doesn’t do it for you, how about median wage growth running well above its post GFC pre COVID trend?

Argument 1: Reaching 2% inflation seems difficult here

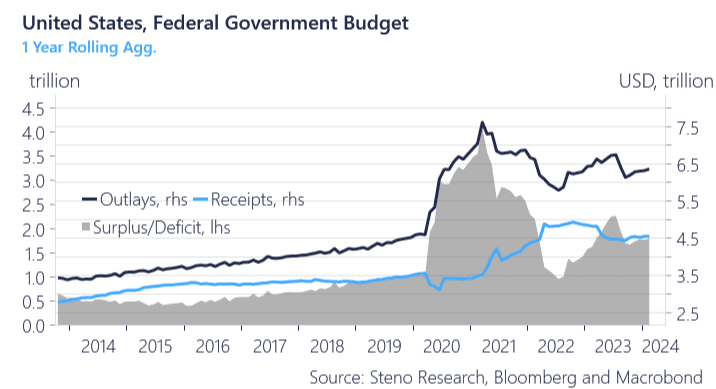

We move onto the second argument where Janet Yellen takes center stage. On a 1 year rolling aggregate the US government is running an almost USD 2 trillion deficit. That doesn’t exactly sound recessionary. On top of that, Yellen has shaped the profile of Treasury issuance to be very bills heavy in order to keep long end yields from running wild. The US fiscal policy is a combination of a war- and an election economy. Both are inflationary!

Argument 2: Yellen doing her utmost not to crash the economy before the election

Find the four remaining arguments below..

Another ‘Out of the Box’ with some food for thought on Fed’s rate path and the most un-appreciated risk scenario, namely more hikes.

0 Comments