Money Watch: Monetary trends scream >2% inflation still (in the US)

Being away from the desk for a few days allows me to take a step back and ponder about some of the biggies in global macro. I have spent the first few evenings in Spain investigating the intriguing differences between Europe and the US in monetary terms.

Conclusions up front:

- USD monetary trends keep outpacing EUR peers, leaving a stickier inflation picture ahead in the US.

- M2-M1 trends are driven by inflation leaving less time-deposits ahead

- Inflation in Europe is (much) more likely to return to 2% than in the US

- Yield curves will lead the way for private credit growth

- USD is likely to outpace European peers on an FX basis

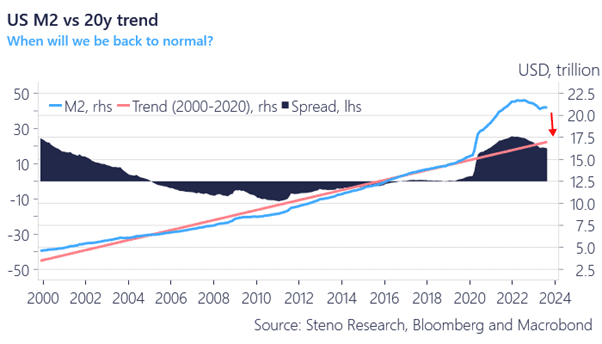

As most of you know by now, I love a bit of base layer monetary analysis. The USD M2 trend remains firmly above the trend and we even see signs of an aggregate rebound in the broad USD supply.

The supply of USDs remains 16% above trend, and with recent signs of a rebound, it seems unwise to bet against the trend from here. Private credit markets remain reasonably solid despite “tight” USD rates.

If you believe that money drives prices (we to a large extent do), then this is a (really) bad sign for intentions of bringing inflation to 2%. What if inflation will never get back to target during this cycle?

Chart 1: USD supply versus a 20-year trend

Monetary trends drive private credit. A steeper curve will bring back the money momentum in the US, while we see diverging trends in Europe and the US.

0 Comments