Macro Regime Indicator May – UP UP UP!

Welcome to our monthly flagship asset allocation analysis – the “Macro Regime Indicator”.

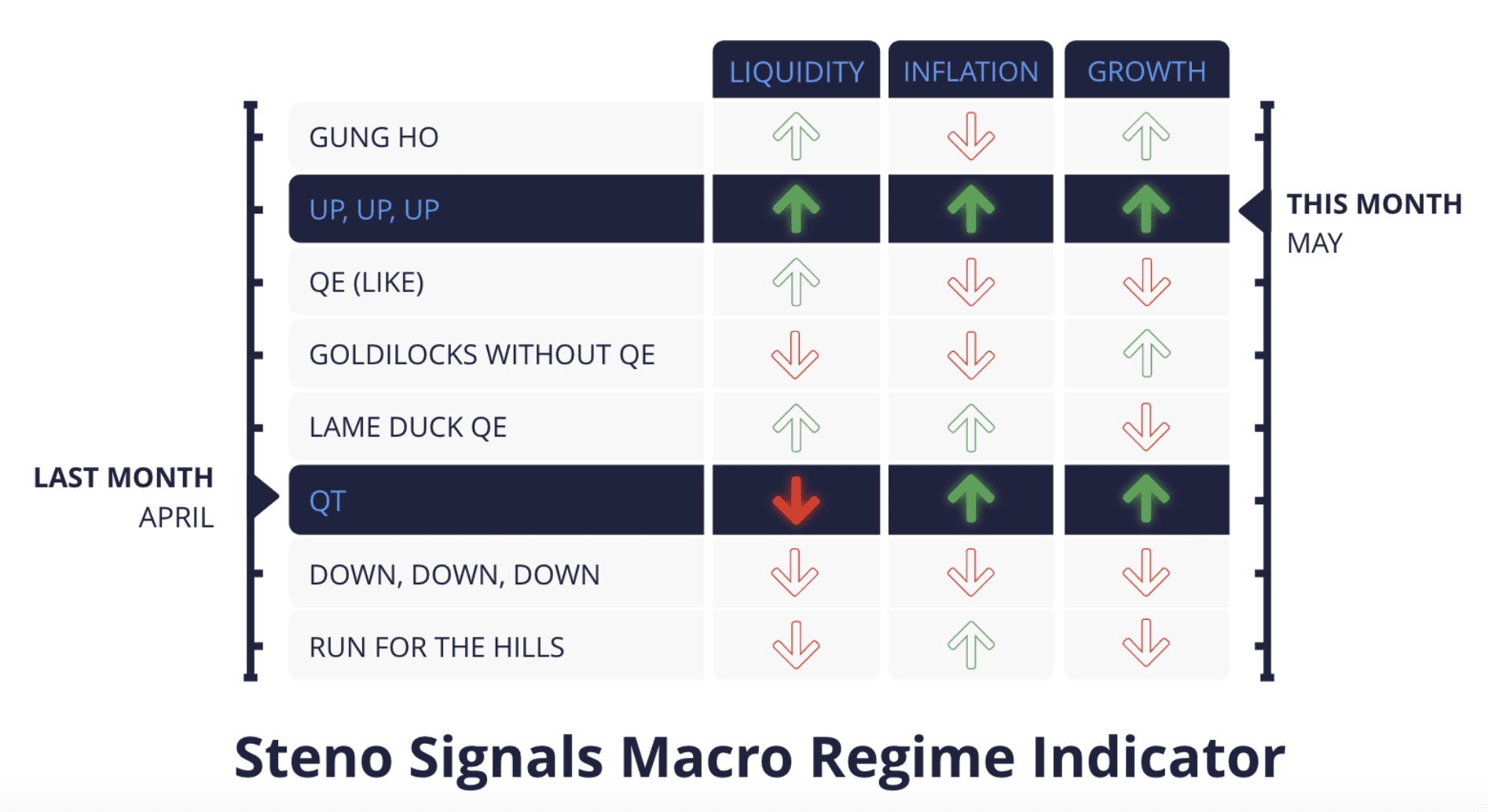

Coming into April, we wrote that “The macro environment is turning worse on both inflation -and liquidity metrics, while the growth variable remains positive (measured by the cyclical manufacturing momentum). This leaves us in a classic “QT” environment with less obvious “gung ho” risk taking through April compared to the full-on risk positive environment we have seen over the past 4-5 months as continuously flagged and traded via our allocation tools.”

Without the growth parameter being a home-run in our models, we mostly got the April correction right and also capitalized decently well on the liquidity withdrawal and the hot inflation report.

In May, our models hint of an “Up,Up,Up” environment in inflation, growth and liquidity, which is a decently positive indicator for risk assets, but also for broader reflationary trades returning through the month and into June.

Let’s have a look at the details.

Chart 1: Steno Research Macro Regime Model May

We are back in a more positive macro environment after a weak April that we timed well in advance. The tide is turning on a couple of the major inputs in our Macro Regime model.

0 Comments