Japan Watch: 1% with added flexibility – more or less printing from here?

Morning from Europe

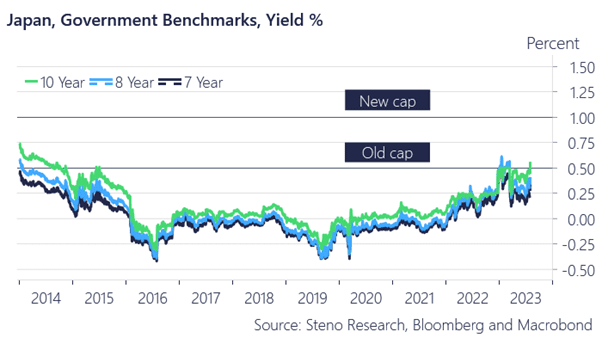

The Bank of Japan moved the needle on the 10yr YCC from an effective cap 0.5% to a new effective cap at 1% but with a larger flexibility being introduced to the setup.

This also means that JGBs are now effectively tradeable again and that two-way-traffic is introduced as the BoJ can decide to guide the 10yr point both higher and lower within the accepted range given incoming data on prices ahead. This is very different from just communicating a new clear cap and the 10yr yield is trading around +56 bps on the screens by the time of writing.

We are yet to see the type of aggressive chasing of the new yield cap as we saw after Dec-22 to raise the bar to +50 bps, which is probably also the exact point in communicating ambiguously around the de facto target level in the new regime. This is not as openly hawkish as the Dec-22 move.

Chart 1: Bank of Japan moving the needle

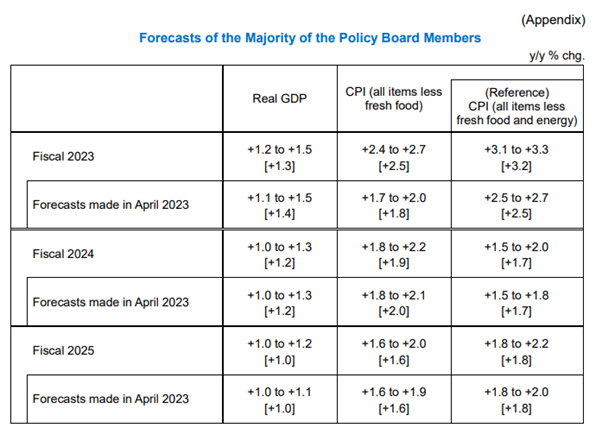

The new forecasts for inflation in the fiscal years ahead acknowledged that move from the Cabinet Office (as we warned you about here by raising the central projection for inflation in the fiscal year of 2023 by 0.7%-points.

Interestingly, the projection has NOT been increased for 2024, it has rather been lowered from 2% to 1.9%, while being kept at 1.6% in 2025. This is a deliberate dovish packaging of the move in the YCC and something to notice.

The very first sentence of the PDF communicating the chance to the YCC-level is the following; “The Bank judges that sustainable and stable achievement of the price stability target of 2 percent has not yet come in sight, and thus patiently continues with monetary easing.”, which rhymes with a very dovish packaging of the new YCC-regime and a continued communication that the BoJ intends to net/net ease policy by still increasing the monetary base via fixed operations.

We are still far from deliberate balance sheet contraction as we see in the US or in Europe.

Chart 2: New fiscal year projections for inflation from the BoJ

What are the main market-takeaways from this move?

Find out how we trade the Japanese market and whether this could pull the rug from under USD and EUR based markets below.

The Bank of Japan did indeed move the needle as the big spike in the short-term inflation forecast provided them with an excuse. The big question is whether the move will lead to more or less printing? And whether the packaging is dovish enough to keep markets calm?

0 Comments