Inflation Watch: Why EUR inflation will print below 2% before New Years

It’s Jackson Hole week and even if Wyoming is typically only full of cowboys (also when CBs gather), they are joined by a cowgirl from France this week for the conference.

The Fed and the ECB will enter the yearly conference with different macroeconomic backdrops as the US growth and inflation momentum seems stickier than Euro peers on our models.

And using leads/lags from the European PPI basket and the US HICP index, we intend on showing you that sub 2% inflation in Europe is a clear possibility in just 3 months from now.

Conclusions up front:

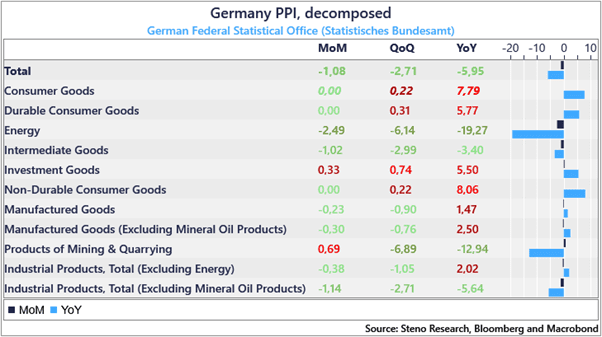

– PPIs from Germany suggest that goods pricing will slide to <0% in the CPI in 2-3 months

– US CPI is held up by shelter and the EUR HICP has a neglectable housing component

– US HICP trends suggest that EUR HICP prints at 1.7%-1.8% before New Years

– Receive EUR vs. USD spreads in Z3 or short EUR versus either USD or Asian FX

Chart 1: German PPI decomposed (green = deflation)

US inflation is already gone ex shelter, while EUR inflation remains elevated. Using simple lead/lag patterns from PPIs and US inflation lead to the conclusion that EUR inflation will actually reach <2% territory in 3-4 months. Interesting backdrop for the Jackson Hole!

0 Comments